Introduction to Residual Risk

In information security, residual risk refers to the level of threat that persists after all security measures and controls have been applied. It is the risk that remains when all planned security strategies have been executed. Understanding residual risk informs the ongoing development and adjustment of security protocols.

Defining Residual Risk in Information Security

Residual risk is distinct from inherent risk, which is the initial level of threat before any controls are implemented. While inherent risk represents the potential for threat in a perfect storm scenario, residual risk is the reality after the storm has been weathered with the best defences in place.

The Importance of Residual Risk Awareness

For professionals overseeing cybersecurity, grasping the nuances of residual risk is critical. It enables them to make informed decisions about where to allocate resources and how to prioritise their risk management efforts.

Residual Risk in the Risk Management Framework

Residual risk occupies a necessary position within the overall risk management process. It benchmarks the effectiveness of security controls is measured and serves as a guide for further action. By continuously monitoring and reassessing residual risk, organisations can adapt their strategies to evolving threats and maintain a robust security posture.

Calculating Residual Risk

Understanding how to calculate residual risk is essential for your organisation’s risk management process. Residual risk is the risk that remains after security controls are applied to inherent risk. The formula used is:

Residual Risk = Inherent Risk – Control Impact

Impact of Security Controls

Security controls, whether they are administrative, technical, or physical, play a significant role in mitigating inherent risks. By implementing effective controls, your organisation can reduce the inherent risk to an acceptable level of residual risk.

Revisiting Residual Risk Calculations

It is important to revisit and recalculate residual risk periodically, especially when there are changes in the threat landscape, business processes, or when new security controls are implemented.

Importance of Accurate Calculation

Accurate calculation of residual risk is essential for decision-making. It informs your organisation of the effectiveness of current security measures and whether additional controls or changes are necessary to protect your digital assets.

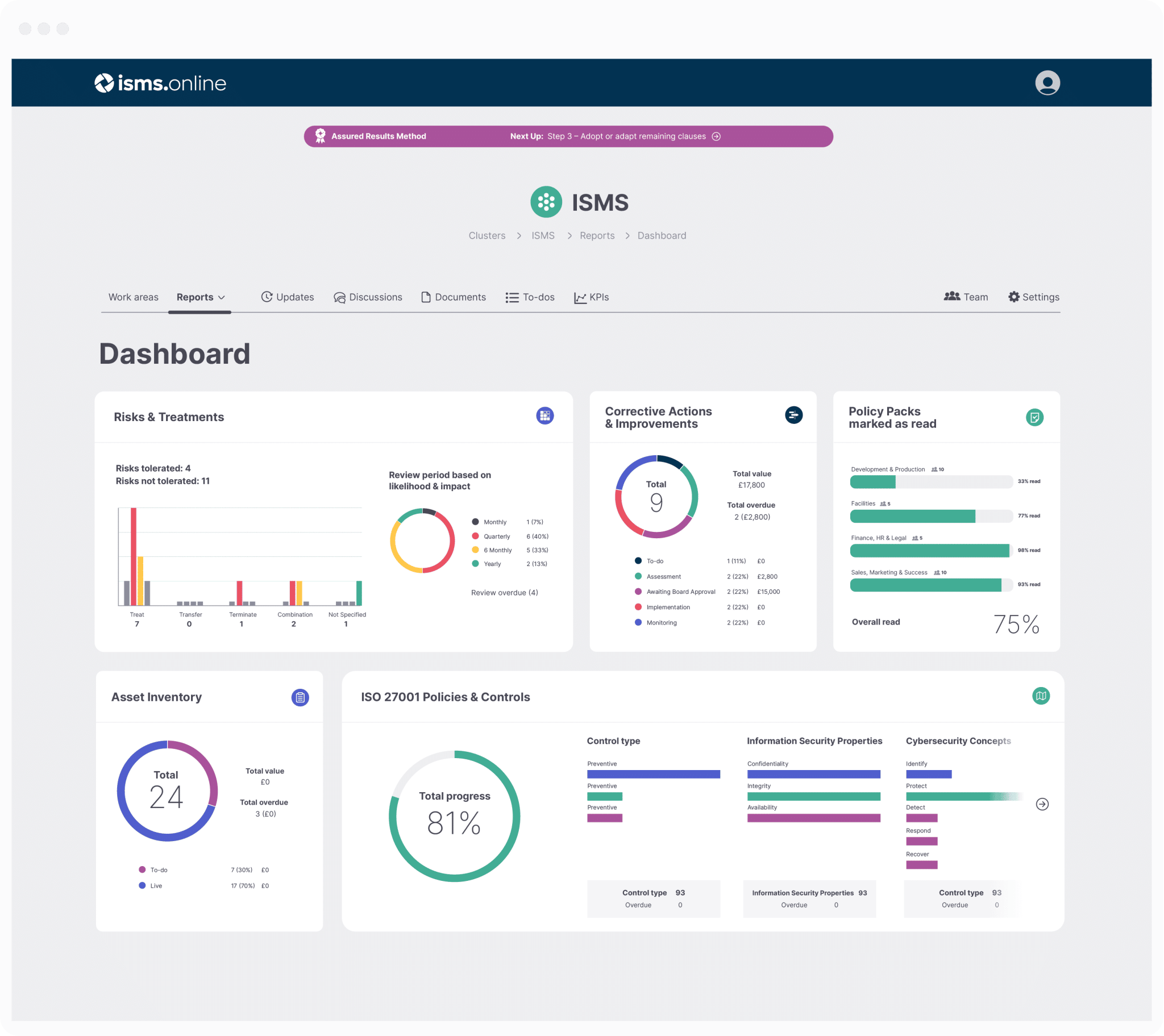

The Role of ISO 27001 in Managing Residual Risk

ISO 27001 is an international standard that outlines the requirements for an information security management system (ISMS). It provides a systematic approach to managing sensitive company information, ensuring it remains secure.

Addressing Residual Risk in ISO 27001

ISO 27001 addresses residual risk by requiring organisations to conduct regular risk assessments, identify risks, and implement appropriate security controls. It emphasises the need for continuous improvement, ensuring that residual risks are managed and mitigated over time.

Compliance Requirements

The standard sets specific compliance requirements for managing residual risk, including the establishment of a risk treatment plan and the implementation of risk treatment processes to reduce residual risk to an acceptable level.

Importance of ISO 27001 Certification

Certification to ISO 27001 demonstrates that your organisation has identified risks and put in place preventative measures to protect against information security breaches. It is a mark of trust and assurance for clients and stakeholders.

Reviewing Compliance

Organisations should review their compliance with ISO 27001 regularly, especially after significant changes to the ISMS, to ensure that residual risks remain within acceptable tolerance levels.

Implementing Security Controls to Mitigate Residual Risk

Effective management of residual risk is contingent upon the implementation of robust security controls. These controls are categorised into three types: preventive, detective, and corrective.

Types of Security Controls

Preventive controls are designed to prevent security incidents before they occur. Detective controls aim to identify and signal ongoing or occurred security events, while corrective controls are implemented to restore systems and processes following an incident.

Measuring Control Effectiveness

The effectiveness of these controls is measured through regular testing and auditing. This includes cybersecurity audits and penetration testing, which evaluate the security posture and identify any gaps in the controls.

Benefits of a Layered Security Approach

A layered security approach, also known as defence in depth, provides multiple layers of protection across the organisation’s information systems. This approach ensures that if one control fails, others are in place to maintain security.

Updating Security Controls

Security controls should be reviewed and updated in response to new threats, vulnerabilities, or changes in the organisation’s operations or risk appetite. This ensures that the controls remain effective and that residual risk is kept within acceptable levels.

Establishing Risk Tolerance and Appetite

Organisations must define their risk tolerance and appetite to effectively manage residual risk. Risk tolerance is the level of risk an organisation is willing to accept, while risk appetite is the amount of risk an organisation is willing to pursue or retain.

Aligning Risk Tolerance with Business Objectives

Aligning risk tolerance with business objectives ensures that the organisation’s risk management practices support its overall strategic goals. This alignment helps in making informed decisions about which risks to accept, mitigate, or transfer.

Factors Influencing Risk Tolerance

Several factors influence an organisation’s risk tolerance, including financial stability, industry standards, regulatory requirements, and market position. Each organisation’s risk tolerance is unique and must be tailored to its specific circumstances.

Re-evaluating Risk Tolerance Levels

Risk tolerance levels should be re-evaluated regularly, especially when there are significant changes in the business environment, organisational structure, or the regulatory landscape. This ensures that the organisation’s risk management strategy remains relevant and effective.

Strategies for Managing Residual Risk

Within the context of information security, managing residual risk is a dynamic process that requires a strategic approach. Organisations must employ a variety of strategies to ensure that residual risks are kept within acceptable levels.

Prioritising Residual Risks

To effectively manage residual risk, organisations must prioritise risks based on their potential impact and the likelihood of occurrence. This prioritisation helps in focusing resources on the most significant risks.

Proactive Risk Management

A proactive approach to residual risk management involves anticipating potential risks and implementing strategies to mitigate them before they materialise. This forward-thinking stance is essential for maintaining robust security.

Adjusting Mitigation Strategies

Mitigation strategies should be regularly reviewed and adjusted in response to the ever-changing risk landscape. This includes staying informed about emerging threats and adapting risk management practices accordingly.

Continuous Monitoring and Threat Intelligence

By maintaining ongoing vigilance over network activity and security events, organisations can detect and respond to threats in real-time.

Role of Threat Intelligence

Threat intelligence plays a key role in identifying potential residual risks. It involves analysing data on current threats to predict and prevent future security incidents. This proactive measure is essential for staying ahead of potential vulnerabilities.

Importance of Real-Time Data

Real-time data is invaluable for managing residual risk as it allows for immediate detection and response to security threats. Timely information ensures that organisations can quickly adapt their security measures to mitigate risks as they arise.

Updating Monitoring Strategies

Monitoring strategies should be updated regularly to reflect new threats and changes in the organisation’s infrastructure. This ensures that the monitoring systems remain effective and that the organisation’s security posture is resilient against evolving threats.

Risk Transfer Mechanisms and Insurance

Available Risk Transfer Mechanisms

Organisations have several mechanisms at their disposal for transferring residual risk. These include entering into contracts that allocate risks to other parties, purchasing cyber risk insurance, and engaging in hedging transactions.

Cyber Risk Insurance as a Transfer Tool

Cyber risk insurance is designed to mitigate financial losses from incidents such as data breaches, network damage, and business interruption. It transfers the financial risk associated with cyber threats from the organisation to the insurer.

Choosing Transfer Over Mitigation

An organisation may opt to transfer risk instead of mitigating it when the cost of implementing controls exceeds the potential benefit, or when it is not feasible to reduce the risk any further through mitigation efforts.

Timing for Risk Transfer Consideration

Risk transfer options should be considered during the risk assessment process and revisited whenever there are significant changes in the organisation’s risk profile or the broader cyber threat landscape.

Preparing for Security Incidents and Data Breaches

Impact of Residual Risk on Incident Response

Residual risk can significantly influence an organisation’s incident response plan. It represents the potential threats that remain after all preventive measures have been applied. Therefore, an incident response plan must account for these risks to ensure comprehensive preparedness.

Minimising Impact During a Breach

To minimise the impact of residual risk, organisations should implement a robust incident response plan that includes immediate containment strategies, communication protocols, and recovery processes. Regular training and simulations can enhance the organisation’s readiness to respond effectively.

Importance of a Robust Response Plan

A robust response plan is essential for mitigating the effects of residual risks. It ensures that the organisation can quickly recover from security incidents, thus minimising downtime and financial losses.

Reviewing and Testing Response Plans

Incident response plans should be reviewed and tested regularly to ensure they remain effective against current threats. This includes updating the plan to reflect new vulnerabilities and conducting drills to assess the organisation’s response capabilities.

Technological Solutions for Residual Risk Management

As it pertains to residual risk management, technological solutions play a pivotal role. These tools and technologies are designed to monitor, detect, and respond to security threats, thereby reducing the level of risk that organisations face.

Advanced Tools and Automation

Advanced tools such as Intrusion Detection Systems (IDS) and Security Information and Event Management (SIEM) systems are integral for real-time monitoring and threat detection. Automation and Artificial Intelligence (AI) enhance these systems, enabling them to adapt to new threats and reduce the need for manual intervention.

Criticality of Technology Adoption

Adopting these technologies is critical for effective residual risk management. They provide the capability to quickly identify and mitigate risks, ensuring that your organisation’s security posture is proactive rather than reactive.

Updating Technological Solutions

Technological solutions should be updated or replaced when they no longer meet the organisation’s security requirements or when new, more effective solutions become available. Regular reviews of the technology stack are essential to maintain a strong defence against evolving cybersecurity threats.

Navigating the Regulatory Landscape

The evolving compliance and legal requirements have a direct impact on the management of residual risk. As regulations change, the strategies to mitigate and transfer risk must also adapt to ensure continued compliance and protection of assets.

Strategies to Stay Ahead of Regulatory Changes

To stay ahead of regulatory changes, organisations should implement a proactive approach. This includes regular reviews of legal updates, consultation with compliance experts, and participation in industry forums. Staying informed enables organisations to anticipate and prepare for changes, rather than react to them after they occur.

Compliance as a Key Consideration

Regulatory compliance is not just a legal obligation; it is a strategic component of residual risk management. Compliance ensures that risk management practices meet the required standards, which can prevent legal penalties and enhance the organisation’s reputation.

Timing for Compliance Audits

Organisations should schedule compliance audits regularly and in response to significant changes in the regulatory environment. These audits assess the organisation’s adherence to legal requirements and standards, such as ISO 27001, and ensure that residual risks are managed according to these benchmarks.

Key Takeaways in Residual Risk Management

For those responsible for safeguarding an organisation’s digital assets, understanding and managing residual risk is fundamental. Residual risk is the risk that persists after all risk management efforts have been applied. It is a reflection of the effectiveness of the organisation’s risk treatment strategies.

Creating a Culture of Continuous Improvement

Organisations should build a culture where continuous improvement in risk management is a shared responsibility. Regular training, open communication, and a willingness to adapt to new threats are essential components of this culture.

Resilience as a Strategic Goal

Resilience against residual risk is not just about preventing incidents but also about the ability to recover swiftly when they occur. This resilience is built through robust planning, implementation of strong security controls, and ongoing risk assessment.

Reassessing Risk Management Approaches

Organisations must reassess their risk management approaches periodically, especially after significant changes in the threat landscape, business processes, or when new compliance regulations come into effect. This reassessment ensures that the organisation’s risk management strategy remains aligned with its risk appetite and business objectives.