Introduction to Risk Ownership

A risk owner is typically a senior member of staff charged with the responsibility of managing specific risks. This role is key to ensuring that potential threats to information security are identified, assessed, and mitigated effectively.

The Important Role of a Risk Owner

The risk owner’s role is to ensure that risks are managed in accordance with the organisation’s risk appetite and tolerance. They are instrumental in maintaining the confidentiality, integrity, and availability of information systems.

Integrating Risk Ownership with Organisational Frameworks

Risk owners do not operate in isolation; they are integral to the broader organisational risk management framework. They work in tandem with enterprise risk management (ERM) to align information security risks with enterprise-wide risk management strategies, ensuring a cohesive approach to risk.

Objectives of Assigning Risk Ownership

The primary objectives of assigning risk ownership include establishing clear accountability for risk decisions and actions, enhancing the organisation’s ability to respond to and recover from adverse events, and ensuring that risk management practices are consistent with the organisation’s overall risk posture.

Defining the Role and Responsibilities of a Risk Owner

In Information Security Risk Management (ISRM), a risk owner is entrusted with specific duties that are pivotal to safeguarding an organisation’s informational assets. Unlike other roles within risk management, risk owners are directly accountable for the evaluation and treatment of risks associated with information security.

Key Responsibilities

Risk owners are tasked with:

- Identifying Risks: Pinpointing potential threats to information security

- Assessing Risks: Evaluating the likelihood and impact of identified risks

- Mitigating Risks: Implementing measures to reduce the vulnerability of information assets.

Strategic Contribution

Risk owners play a required role in:

- Budgeting: Allocating resources effectively to address information security needs

- Strategic Planning: Integrating risk management with the organisation’s strategic objectives.

Required Qualifications and Skills

Effective risk owners typically possess:

- Analytical Skills: To assess risks accurately and devise appropriate mitigation strategies

- Knowledge of Standards: Familiarity with frameworks such as ISO 27001 is essential

- Communication Abilities: To articulate risks and strategies to stakeholders across the organisation.

By fulfilling these responsibilities and using their skills, risk owners ensure that information security risks are managed proactively, aligning with the organisation’s broader risk management framework and strategic goals.

The Necessary Role of Risk Owners in Cybersecurity

Influence on Security Policies

Risk owners are instrumental in:

- Developing Policies: Crafting guidelines that govern the protection of information assets

- Enforcing Policies: Ensuring adherence to these guidelines across the organisation.

Fostering a Security Culture

Risk owners contribute to:

- Security Awareness: Educating employees about cybersecurity risks and best practices

- Behavioural Change: Encouraging practices that enhance the organisation’s security posture.

Organisational-Wide Protection

Risk owners enable:

- Unified Defence: Aligning cybersecurity measures with organisational goals and risk appetite

- Proactive Measures: Implementing strategies to anticipate and mitigate potential cyber threats.

Through these efforts, risk owners play a pivotal role in maintaining the resilience of an organisation’s cybersecurity defences.

Frameworks and Standards Guiding Risk Owners

Risk owners operate within a structured set of frameworks and standards that delineate their role and responsibilities. These guidelines are essential for ensuring that risk management practices align with recognised best practices and legal requirements.

Role Definition in ISO 27001

ISO 27001, a leading international standard for information security management systems (ISMS), provides a clear framework for risk owners. It outlines the need for identifying risks, assessing their potential impact, and implementing appropriate controls to mitigate them.

Complementary Frameworks

In addition to ISO 27001, risk owners may also refer to:

- NIST Frameworks: Offering guidance on cybersecurity and privacy controls

- COBIT: Providing a comprehensive approach to IT governance and risk management.

Integration with Enterprise Risk Management

These standards facilitate the integration of ISRM with enterprise risk management by:

- Aligning Objectives: Ensuring that information security risks are considered within the broader organisational risk profile

- Harmonising Practices: Creating consistency in risk assessment and mitigation across different organisational units.

Compliance with Legal and Regulatory Requirements

Risk owners are responsible for:

- Staying Informed: Keeping abreast of relevant privacy laws and regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA)

- Ensuring Adherence: Implementing policies and procedures that comply with these legal requirements.

By adhering to these frameworks and standards, risk owners can effectively manage information security risks in a manner that supports organisational objectives and complies with legal obligations.

Methodologies for Risk Assessment and Prioritisation

Risk owners employ systematic methodologies to identify and prioritise information security risks. This process is critical for developing an effective risk management strategy.

Stages of Risk Assessment

The assessment process typically involves:

- Asset Identification: Cataloguing the information assets that require protection

- Threat and Vulnerability Analysis: Identifying potential threats and vulnerabilities that could impact these assets

- Impact and Likelihood Assessment: Evaluating the potential consequences and the probability of these risks materialising.

Prioritisation of Risks

Risk owners prioritise risks by:

- Risk Scoring: Assigning a score based on the impact and likelihood assessment

- Risk Ranking: Ordering risks to address the most significant threats first.

Decision-Making on Risk Treatment Options

Risk owners must decide on the most appropriate treatment options for the identified risks. Options include:

- Remediation: Directly addressing the vulnerability to remove the risk

- Mitigation: Reducing the impact or likelihood of the risk

- Transference: Shifting the risk to a third party, such as through insurance

- Acceptance: Acknowledging the risk and choosing to monitor it without immediate action

- Avoidance: Eliminating the risk by discontinuing the activity that generates it.

Addressing Challenges in Risk Mitigation

Common challenges in risk mitigation can be addressed by:

- Stakeholder Engagement: Ensuring all relevant parties are informed and involved in the risk management process

- Resource Allocation: Securing adequate resources for implementing risk treatment measures.

Continuous Improvement in Risk Management

Continuous improvement practices are applied by:

- Monitoring and Review: Regularly reassessing risks and the effectiveness of treatment strategies

- Feedback Loops: Incorporating lessons learned into the risk management process for ongoing refinement.

Effective Risk Communication with Stakeholders

Risk owners are tasked with the essential role of communicating complex risk information to stakeholders in a manner that is both clear and actionable.

Strategies for Clear Risk Communication

To ensure clarity and effectiveness in risk communication, risk owners:

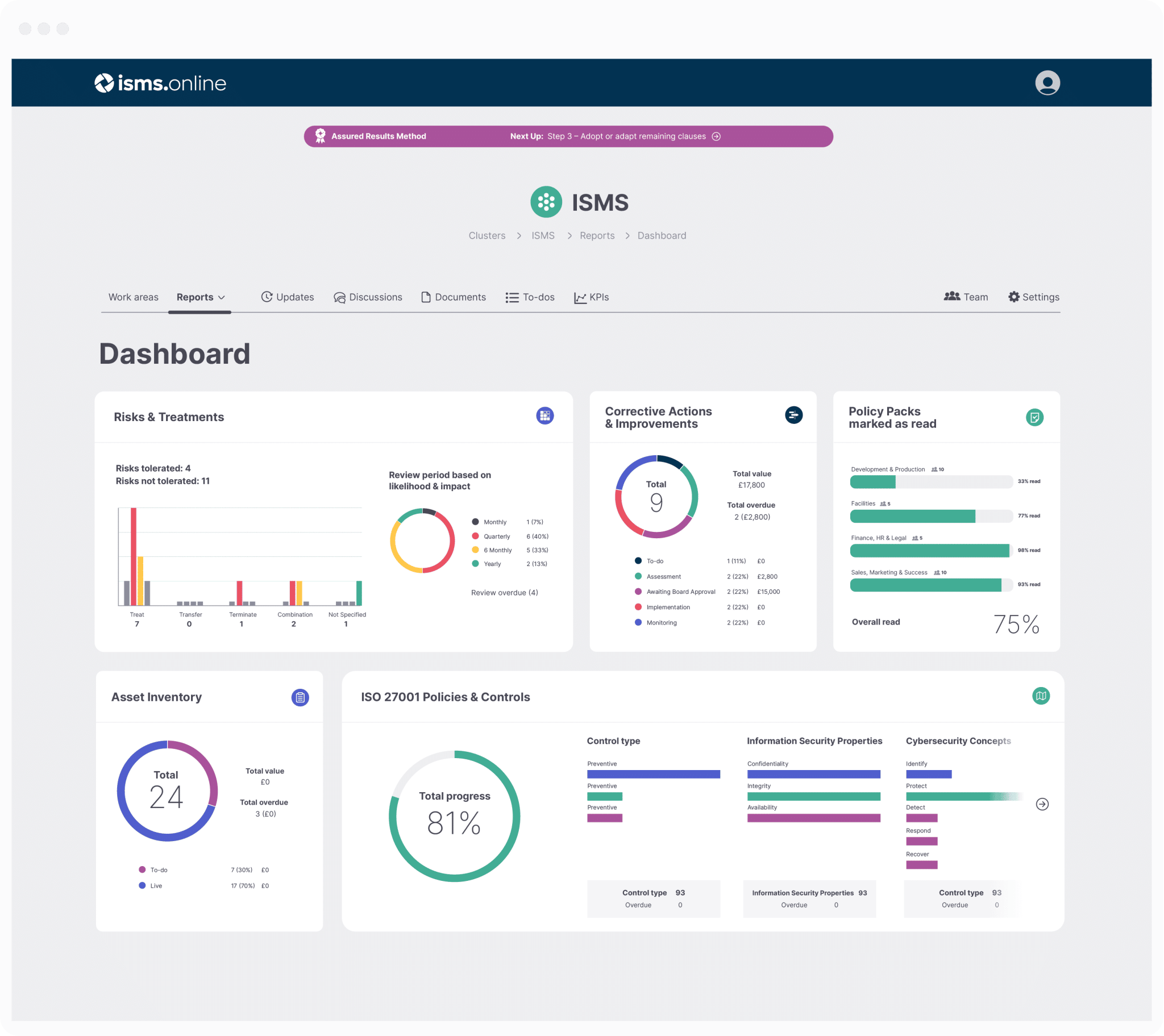

- Use Data Visualisation: Employ charts and graphs to illustrate risk assessments and trends

- Conduct Regular Briefings: Update stakeholders on current risk landscapes and mitigation efforts

- Develop Clear Documentation: Create comprehensive reports that detail risk management activities and decisions.

Collaboration with Organisational Roles

Risk owners work in concert with other key figures within the organisation, such as:

- Chief Information Security Officers (CISOs): Aligning risk management strategies with overall cybersecurity policies

- Information Technology Managers: Ensuring that technical controls and infrastructure support risk mitigation efforts.

The Role of Psychological Safety in Risk Communication

Psychological safety is fundamental to effective risk communication, as it:

- Encourages Open Dialogue: Stakeholders feel comfortable discussing risks and potential impacts without fear of negative repercussions

- Promotes Transparency: Clear and honest communication about risks fosters trust and informed decision-making.

By adopting these communication strategies, risk owners can effectively convey critical risk information, ensuring that all stakeholders are informed and engaged in the organisation’s risk management processes.

Approaches to Managing Third-Party and Vendor Risks

Risk owners are responsible for extending the scope of risk management to include third-party and vendor risks. This involves a series of strategic approaches designed to safeguard an organisation’s information assets.

Conducting Vendor Risk Assessments

To manage third-party risks, risk owners:

- Evaluate Vendor Security Postures: Assess the security measures and policies of vendors to ensure they meet the organisation’s standards

- Analyse Service Level Agreements (SLAs): Review contractual agreements to identify and mitigate potential risks in vendor services.

Integrating Vendor Risks into Overall Risk Management

Vendor risk assessments are integrated into the broader risk management strategy by:

- Aligning with Organisational Risk Appetite: Ensuring third-party engagements are consistent with the organisation’s tolerance for risk

- Updating Risk Registers: Including third-party risks in the organisation’s central repository for tracking and monitoring risks.

Addressing Challenges in Third-Party Risk Management

Risk owners navigate challenges in third-party risk management by:

- Establishing Clear Communication Channels: Facilitating regular discussions with vendors to address security concerns

- Implementing Continuous Monitoring: Keeping track of vendor performance and compliance to quickly identify and respond to new risks.

Through these methods, risk owners ensure that third-party and vendor risks are managed effectively, maintaining the integrity of the organisation’s risk management framework.

Role of Risk Owners in Incident Response Planning

Risk owners are pivotal in crafting and maintaining incident response plans that are required for an organisation’s resilience against information security incidents.

Developing Incident Response Plans

Risk owners are involved in:

- Creating Comprehensive Plans: Outlining procedures and roles for responding to security incidents

- Collaborating with Stakeholders: Working with various departments to ensure a cohesive response strategy.

Contributing to Business Continuity

Risk owners ensure business continuity by:

- Identifying Critical Assets: Pinpointing systems and data essential for the organisation’s operations

- Planning for Redundancies: Establishing backups and failovers to maintain service during disruptions.

Ensuring Effective Incident Response

An effective incident response plan, from the perspective of risk owners, includes:

- Clear Communication Protocols: Defining how and when to communicate during an incident

- Defined Roles and Responsibilities: Assigning specific tasks to team members for an organised response.

Regular Testing and Updating of Plans

Risk owners are responsible for:

- Conducting Regular Drills: Simulating incidents to test the effectiveness of response plans

- Iterative Improvements: Updating plans based on test outcomes and evolving threats.

Through these actions, risk owners help to prepare the organisation to handle and recover from security incidents efficiently.

Navigating Compliance in Risk Management

Risk owners are tasked with the critical responsibility of ensuring that their organisations adhere to a complex web of privacy laws and regulations. This role is particularly challenging given the dynamic nature of legal requirements as it pertains to information security.

Impact of Regulations on Risk Owners

The introduction of regulations such as GDPR and CCPA has significantly expanded the scope of responsibilities for risk owners. They must now:

- Understand Legal Requirements: Stay informed about the details and implications of privacy laws that affect the organisation

- Implement Compliance Measures: Ensure that policies and procedures are in place to meet the legal standards.

Ensuring Organisational Compliance

To maintain compliance, risk owners:

- Conduct Regular Audits: Evaluate current practices against regulatory requirements

- Update Policies: Revise information security policies to reflect changes in the law.

Consequences of Non-Compliance

Non-compliance can lead to:

- Legal Repercussions: Including fines and sanctions that can have a substantial financial impact

- Reputational Damage: Loss of trust among customers and stakeholders.

Risk owners play an important role in navigating these complexities, ensuring that their organisations remain on the right side of the law while protecting sensitive information.

Adapting to the Evolving Threat Landscape

The role of risk owners is continually reshaped by the advent of emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and blockchain. These technologies not only bring new opportunities but also introduce novel and complex cybersecurity challenges.

Strategies for Staying Ahead

To stay ahead of evolving threats, risk owners:

- Engage in Continuous Learning: Keeping abreast of the latest technological advancements and their associated risks

- Leverage Cyber Threat Intelligence: Utilising up-to-date information about potential threats to inform risk assessments and mitigation strategies.

Influence of Emerging Technologies on Risk Management

Emerging technologies impact risk management by:

- Expanding the Attack Surface: Introducing new vectors for potential security breaches

- Requiring New Mitigation Techniques: Necessitating the development of innovative security measures to protect against sophisticated attacks.

Role of Cyber Threat Intelligence

Cyber threat intelligence plays a necessary role by:

- Informing Decision-Making: Providing risk owners with actionable insights to make informed decisions about cybersecurity strategies

- Enhancing Risk Assessments: Enriching the risk assessment process with current data on threats and vulnerabilities.

Risk owners must remain vigilant and proactive, adapting their strategies to effectively manage risks.

Evolution and Future Trends Affecting Risk Owners

The role of risk owners has undergone significant evolution, driven by the rapid advancement of technology and the ever-changing threat landscape. As organisations increasingly recognise the importance of information security, risk owners find themselves at the forefront of developing and implementing strategies to protect digital assets.

Emerging Trends Influencing Risk Owners

Risk owners must stay vigilant and adaptable in the face of trends such as:

- Increased Regulatory Scrutiny: With regulations like GDPR and CCPA setting new precedents, risk owners must ensure compliance while adapting to evolving legal frameworks

- Advancements in Technology: The rise of AI, IoT, and blockchain technologies presents new challenges and opportunities for risk management.

Organisational Support for Risk Owners

Organisations can support their risk owners by:

- Providing Continuous Education: Ensuring access to the latest training and resources to stay informed about emerging risks and best practices

- Fostering Collaboration: Encouraging cross-departmental communication to create a unified approach to risk management.

Key Considerations for CISOs and IT Managers

For CISOs and IT managers, empowering risk owners is essential. They should:

- Allocate Adequate Resources: Ensure risk owners have the tools and support necessary to perform their duties effectively

- Promote a Risk-Aware Culture: Advocate for organisation-wide awareness and understanding of the importance of information security.

By acknowledging these factors, organisations can better equip risk owners to navigate the complexities of information security risk management, ensuring a robust defence against potential threats.