Understanding PCI DSS and Incident Response Measures

When delving into the core of PCI DSS v4.0 Incident Response, it’s essential to understand the foundational elements that constitute this critical aspect of data security. The latest version of the Payment Card Industry Data Security Standard (PCI DSS) brings forth an evolved set of requirements, reflecting the dynamic nature of modern cybersecurity threats.

Foundational Elements of Incident Response

The Incident Response (IR) protocols in PCI DSS v4.0 are built upon a structured approach that emphasises preparation, detection, containment, eradication, recovery, and post-incident analysis. These stages are designed to provide a comprehensive response to security incidents, ensuring minimal impact and swift recovery.

Evolution from Previous Versions

Compared to its predecessor, PCI DSS v4.0 enhances the IR requirements by incorporating more detailed guidelines on roles and responsibilities, testing frequencies, and integration with broader security policies. This evolution signifies a shift towards a more proactive and continuous security posture.

Addressing Modern Cybersecurity Threats

PCI DSS v4.0 addresses the complexities of modern cybersecurity by mandating a customised approach to IR that allows organisations to tailor their response strategies to specific risks and business models. This flexibility is crucial in adapting to the ever-changing threat landscape.

ISMS.online's Role in Facilitating Compliance

At ISMS.online, we understand the importance of aligning with PCI DSS v4.0's Incident Response protocols. Our platform offers a suite of tools and resources that streamline the compliance process, from policy management to risk assessment and staff training. By leveraging our services, you can ensure that your organisation's IR strategy is robust, compliant, and effective against contemporary cybersecurity challenges.Navigating the New Incident Response Requirements

As the Payment Card Industry Data Security Standard (PCI DSS) evolves, so too must the strategies for incident response. With the release of PCI DSS v4.0, there are specific changes that directly affect how organisations prepare for and respond to security incidents. Understanding these changes is crucial for maintaining compliance and protecting cardholder data.

Specific Changes in Incident Response with PCI DSS v4.0

PCI DSS v4.0 introduces enhanced requirements for incident response that reflect the complexities of modern cybersecurity. These changes include more detailed guidelines for developing an Incident Response Plan (IRP) that addresses the identification, containment, and recovery from security breaches. The new version emphasises the importance of continuous security, including regular testing and revision of the IRP.

Impact on Compliance Officers’ Roles and Responsibilities

For compliance officers, the updated standard means a reevaluation of roles and responsibilities. You’re now expected to ensure that your organisation’s IRP is not only compliant with the new requirements but also effectively integrated with the overall security strategy. This includes overseeing the training of personnel and the periodic testing of the IRP.

Steps for Organisations to Comply with Incident Response Requirements

To comply with the new Incident Response requirements, your organisation should:

- Review and update your IRP to align with PCI DSS v4.0.

- Conduct thorough risk assessments to identify potential security gaps.

- Implement continuous monitoring and regular testing of the IRP.

- Ensure that all staff are trained on their specific roles within the IRP.

Integration of the Incident Response Plan with PCI DSS Compliance

The IRP is an integral part of your organisation’s overall PCI DSS compliance framework. It should be seamlessly integrated with other security controls and procedures to ensure a coordinated response to any incident.

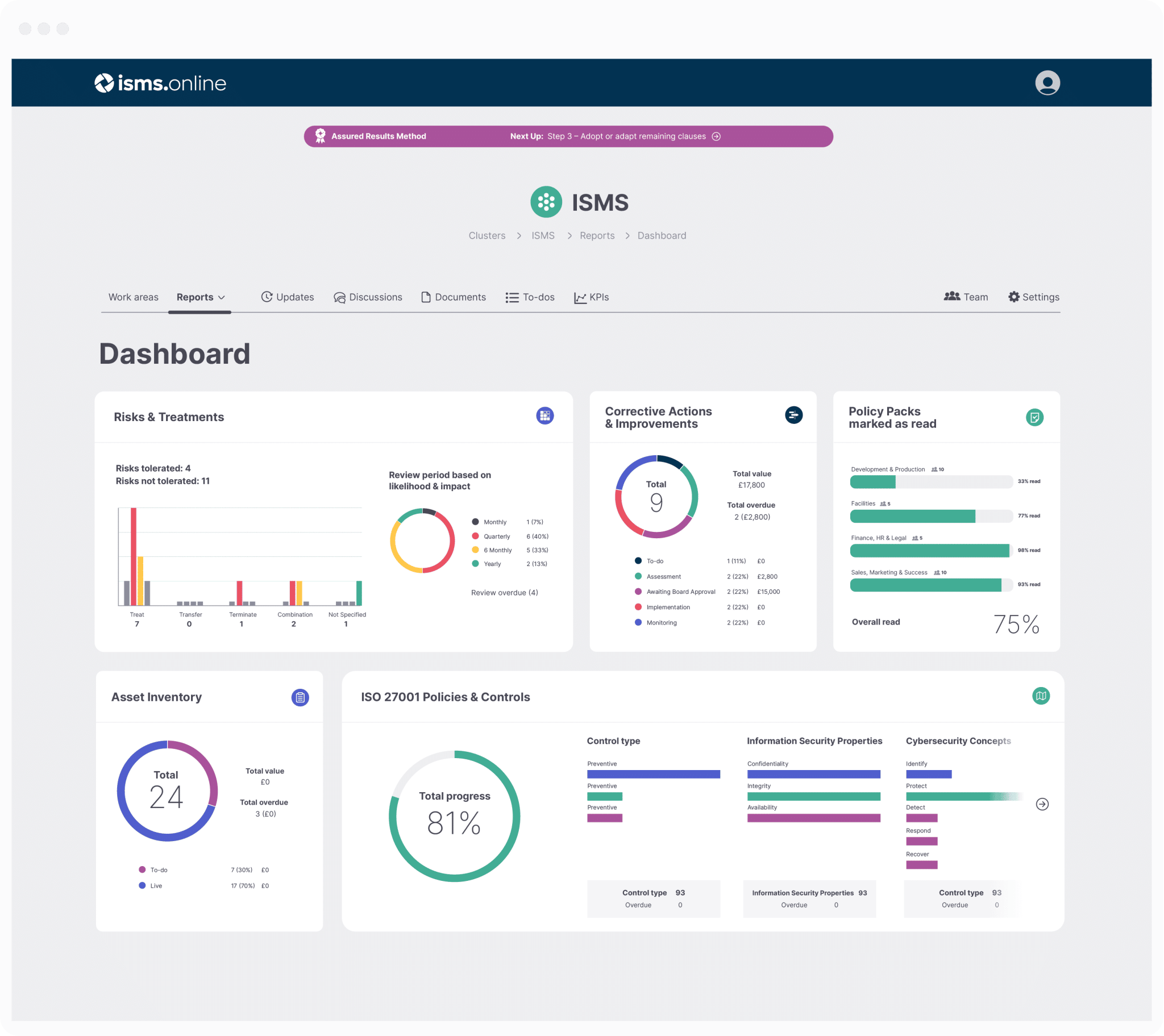

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Components of a PCI DSS Incident Response Plan

A robust Incident Response Plan (IRP) is a cornerstone of PCI DSS v4.0 compliance. Your IRP must include:

- Identification of critical assets and data flows to prioritise protection efforts.

- Clear roles and responsibilities for all team members, ensuring swift action during an incident.

- Detailed response procedures for various types of incidents, including containment and eradication strategies.

- Communication plans both internally and externally, including notification of customers and authorities when necessary.

- Recovery processes to restore systems and data to normal operations securely.

- Post-incident analysis to learn from the incident and improve future response efforts.

Structuring Your Incident Response Team and Processes

Your organisation’s Incident Response team should be structured to enable quick decision-making and action. This includes:

- Designating a team leader who has the authority to make critical decisions.

- Assigning specific tasks to team members based on their expertise.

- Establishing a protocol for incident escalation to ensure timely involvement of senior management.

Best Practices for Documenting and Maintaining Your IRP

To ensure your IRP remains effective, adhere to these best practices:

- Regularly review and update your IRP to reflect new threats and changes in your business environment.

- Conduct training and simulations to ensure team readiness.

- Maintain detailed records of any incidents and responses for compliance verification and improvement.

Streamlining IRP Creation and Management with ISMS.online

At ISMS.online, we understand the complexities of creating and maintaining an IRP. Our platform simplifies this process by providing:

- Pre-configured templates that align with PCI DSS v4.0 requirements.

- Collaborative tools for team coordination and task management.

- Document control features to ensure your IRP is always current and accessible.

By leveraging our services, you can ensure that your IRP is not only compliant but also a robust defence against security incidents.

Incident Response and Risk Management

Incident Response (IR) is not an isolated function; within PCI DSS v4.0, it is deeply integrated into the broader risk management framework. This integration ensures that IR processes are informed by and aligned with the organisation’s overall risk posture and mitigation strategies.

Risk Assessment Requirements for Incident Response

Under PCI DSS v4.0, your organisation is required to conduct regular risk assessments that specifically consider the potential impact of security incidents. These assessments should inform the development and continuous improvement of your IR plan, ensuring it is tailored to the unique risks your organisation faces.

Assessing and Mitigating Risks of Data Breaches

To effectively assess and mitigate risks associated with payment card data breaches, you should:

- Identify and prioritise the assets most critical to your payment card operations.

- Analyse potential threats and vulnerabilities that could lead to a data breach.

- Develop mitigation strategies for identified risks, including both preventive and responsive measures.

Recommended Tools and Methodologies

At ISMS.online, we recommend a combination of tools and methodologies to support your risk management efforts:

- Data discovery tools, such as Card Recon, to identify where cardholder data resides within your systems.

- Automated scanning solutions to continuously monitor for vulnerabilities.

- Incident simulation exercises to test and refine your IR plan.

By incorporating these tools into your risk management practices, you can ensure a proactive and prepared stance against potential security incidents.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Aligning Incident Response with Security Policies

As it relates to PCI DSS v4.0, integrating Incident Response (IR) with your existing security policies is not just a recommendationit’s a necessity. This alignment ensures a unified approach to managing and responding to incidents, which is essential for the protection of cardholder data.

Documentation Requirements for Incident Response

PCI DSS v4.0 mandates comprehensive documentation for your IR policies. This includes:

- Detailed IR procedures that are readily accessible to relevant personnel.

- Clear definitions of roles and responsibilities within the IR framework.

- Records of IR training and testing activities, demonstrating ongoing compliance and preparedness.

Ensuring Up-to-Date and Effective IR Policies

To keep your IR policies both current and effective, you should:

- Regularly review and revise your policies to reflect changes in the threat landscape and business processes.

- Conduct periodic training and simulations to reinforce policy understanding and efficacy.

- Engage in continuous monitoring for new threats and vulnerabilities that may affect your IR readiness.

Policy Integration and Management with ISMS.online

At ISMS.online, we provide a suite of tools and services designed to assist you in integrating and managing your IR policies. Our platform offers:

- Template policies that align with PCI DSS v4.0 requirements.

- Collaborative workspaces for policy development and team input.

- Automated reminders for policy review cycles to ensure your documentation is always up-to-date.

By leveraging our expertise and resources, you can ensure that your IR policies are not only compliant but also a robust component of your organisational security posture.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Staff Training and Incident Response

Training is a critical component of a robust Incident Response (IR) strategy. Under PCI DSS v4.0, staff must be equipped with the knowledge and skills to respond swiftly and effectively to security incidents.

Building Awareness Around Best Practices

Awareness is the first line of defence in incident response. At ISMS.online, we advocate for continuous education to build a culture of security within your organisation. This involves:

- Regular updates on the latest security threats and trends.

- Workshops that reinforce the importance of protecting cardholder data.

- Engaging training modules that encourage active participation from all staff members.

Key Elements of a PCI DSS v4.0 Training Programme

A comprehensive training programme under PCI DSS v4.0 should include:

- Clear explanations of the IR plan and each team member’s role within it.

- Simulated incident exercises to provide hands-on experience.

- Assessments to validate the understanding and readiness of staff.

The Role of Continuous Education in Incident Response

Continuous education ensures that your team remains vigilant and prepared. It contributes to the effectiveness of your IR by:

- Keeping pace with evolving cybersecurity threats.

- Reinforcing the IR plan’s procedures and protocols.

- Promoting a proactive security posture among all employees.

By prioritising training and awareness, you’re not only complying with PCI DSS v4.0 but also fortifying your organisation’s overall security framework.

Further Reading

Regular Testing of Incident Response Plans

For the purpose of cybersecurity, regular testing of your Incident Response (IR) plan is not just a recommendationit’s a requirement under PCI DSS v4.0. Testing ensures that your IR plan is not only theoretically sound but also practically effective.

Frequency of IR Plan Testing

PCI DSS v4.0 mandates that IR plans be tested at least annually. However, we at ISMS.online suggest that you consider more frequent testing depending on your organisation’s size, complexity, and the evolving threat landscape. This could mean bi-annual or even quarterly tests to ensure readiness.

Methods for Testing IR Plan Effectiveness

To gauge the effectiveness of your IR plan, you can employ various methods such as:

- Tabletop exercises, which simulate a breach scenario to test your team’s response.

- Live drills, where you enact the IR plan in a controlled environment.

- Third-party audits, to provide an objective assessment of your plan’s robustness.

Utilising Test Results for IR Strategy Improvement

After testing, it’s crucial to analyse the results and identify areas for improvement. This includes refining communication protocols, updating contact lists, and enhancing technical response capabilities.

ISMS.online’s Role in Enhancing IR Readiness

At ISMS.online, we provide a platform that facilitates the regular testing and updating of your IR plan. Our tools enable you to:

- Document test results and track improvements over time.

- Collaborate on updates to the IR plan with all stakeholders.

- Schedule reminders for future tests to ensure ongoing compliance and readiness.

By integrating these practices, you can ensure that your IR strategy is not only compliant with PCI DSS v4.0 but also resilient against the threats of tomorrow.

Legal and Regulatory Considerations for Incident Response

Navigating the legal and regulatory landscape is a critical aspect of Incident Response (IR) under PCI DSS v4.0. As you develop your IR plan, it’s essential to understand the legal implications and ensure that your procedures are compliant not only with PCI DSS but also with applicable laws and regulations.

Intersection with Other Compliance Frameworks

Your IR plan must align with PCI DSS v4.0 requirements and may also intersect with other regulatory frameworks, such as the Federal Financial Institutions Examination Council (FFIEC) guidelines. To maintain compliance across frameworks, you should:

- Identify overlapping requirements to streamline your compliance efforts.

- Understand the unique aspects of each framework to address specific mandates.

- Integrate best practices from various frameworks to enhance your IR strategy.

Implications of Non-Compliance

Non-compliance with IR requirements can lead to significant consequences, including:

- Financial penalties imposed by card brands or regulatory bodies.

- Reputational damage that can affect customer trust and business continuity.

- Legal action in the event of a data breach or failure to meet regulatory obligations.

Ensuring Compliance with Legal and Regulatory Obligations

To ensure you meet all legal and regulatory obligations for IR, consider the following steps:

- Conduct a thorough compliance assessment to identify any gaps in your IR plan.

- Engage with legal experts who specialise in data security and breach response.

- Regularly update your IR plan to reflect changes in the legal landscape.

At ISMS.online, we provide the tools and expertise to help you navigate these complexities and ensure that your IR plan is robust, compliant, and effective.

Aligning PCI DSS with Global Cybersecurity Standards

PCI DSS v4.0 is designed to align with global cybersecurity and data protection standards, ensuring a cohesive approach to securing cardholder data worldwide. As you’re developing your Incident Response Plan (IRP), it’s important to consider how these global standards intersect with PCI DSS requirements.

Challenges for Multinational Organisations

Multinational organisations face unique challenges when implementing IR across various jurisdictions. Differing legal requirements, cultural considerations, and logistical complexities must be navigated carefully. We at ISMS.online provide the expertise to help you harmonise your IRP with these diverse requirements.

Influence of Global Standards on IRPs

Global standards can significantly influence the development of your IRP by providing a framework for best practices and compliance. They ensure that your IRP meets not just the minimum requirements but also aligns with international expectations for data security and breach response.

Cross-Border Data Transfer Considerations

When dealing with cross-border data transfers, your IRP must address the legal and regulatory requirements of all relevant jurisdictions. This includes ensuring appropriate safeguards are in place and that response measures are compliant with international data protection laws.

At ISMS.online, we understand the complexities of aligning your IRP with global standards. Our platform is equipped to support your organisation in developing an IRP that is robust, compliant, and effective, no matter where your operations may lie.

ISMS.online Supports PCI DSS Incident Response

Navigating the complexities of PCI DSS v4.0 can be daunting, especially when it comes to developing and maintaining an Incident Response Plan (IRP). At ISMS.online, we understand these challenges and are equipped to provide expert assistance tailored to your organisation’s needs.

Developing Your Incident Response Plan with ISMS.online

Our platform offers a comprehensive suite of tools designed to simplify the creation of your IRP. We provide:

- Guided templates that align with PCI DSS v4.0 requirements.

- Collaborative features for team input and plan development.

- Best practice examples to inform your IR strategy.

Navigating PCI DSS v4.0 Compliance

Compliance with PCI DSS v4.0 involves understanding a complex set of requirements. Our support includes:

- Clear explanations of the standards and how they apply to your IRP.

- Step-by-step guidance through the compliance process.

- Updates on changes to the standards to ensure ongoing compliance.

Enhancing Incident Response Capabilities

Partnering with ISMS.online can significantly enhance your IR capabilities by providing:

- Integrated management systems for a unified approach to IR.

- Automated workflows to streamline response actions.

Choosing ISMS.online for Your IR Needs

Organisations choose ISMS.online for our:- Expertise in PCI DSS v4.0 and incident response.

- Proven track record of helping businesses achieve and maintain compliance.

- Commitment to customer support and satisfaction.

For expert guidance on PCI DSS v4.0 and to enhance your organisation's incident response capabilities, contact us at ISMS.online. We're here to help you every step of the way.