The Core Principles of PCI DSS and GDPR

When you’re tasked with safeguarding sensitive data, understanding the foundational objectives of the Payment Card Industry Data Security Standard (PCI DSS) 4.0 and the General Data Protection Regulation (GDPR) is crucial. At ISMS.online, we recognise the importance of these regulations in shaping your data protection strategies.

PCI DSS 4.0: Securing Cardholder Data

PCI DSS 4.0 is designed to protect cardholder data within the digital economy. Its core objectives revolve around establishing a secure environment through a set of 12 requirements. These include implementing robust access control measures, maintaining a vulnerability management programme, and ensuring a strong information security policy.

GDPR: Upholding Personal Data Privacy

The GDPR, on the other hand, aims to protect the personal data of EU residents, emphasising the right to privacy. It extends beyond mere security, incorporating principles like consent, data portability, and the right to be forgotten, ensuring individuals have greater control over their personal information.

Complementary Principles for Enhanced Data Protection

Both PCI DSS 4.0 and GDPR share complementary goals, such as data minimization and the implementation of strong security measures like encryption. While PCI DSS focuses on the security-centric aspects of data protection, GDPR broadens the scope to include privacy rights, creating a comprehensive framework for data governance.

Integrating PCI DSS 4.0 and GDPR with ISMS.online

At ISMS.online, we provide an Integrated Compliance Framework that simplifies the complexity of adhering to both PCI DSS 4.0 and GDPR. Our platform equips you with the tools and guidance needed to navigate the overlapping requirements, ensuring that your organisation not only complies but also thrives in today's data-centric world.PCI DSS 4.0 Meets GDPR

As compliance officers, you’re tasked with the complex challenge of aligning PCI DSS 4.0 with GDPR requirements. Both frameworks are pivotal in shaping the data protection landscape, yet they serve different, albeit complementary, purposes. PCI DSS 4.0 focuses on securing cardholder data, while GDPR broadens the scope to protect all personal data of EU residents, emphasising individual privacy rights.

Harmonised Approach to Data Protection

The overlapping requirements between PCI DSS 4.0 and GDPR offer a harmonised approach to data protection. This alignment is evident in their shared emphasis on risk assessments, encryption, and access control. By adhering to these commonalities, your organisation can streamline compliance efforts, ensuring robust protection of consumer information.

Effective Compliance Strategies

To navigate this landscape effectively, we recommend adopting strategies that address both sets of regulations. This includes implementing comprehensive data protection policies, regular security testing, and maintaining transparent data processing records. Our platform, ISMS.online, provides tools and frameworks to support these strategies, simplifying the compliance process.

Global Impact on Data Protection Practices

The intersection of PCI DSS 4.0 and GDPR extends beyond individual compliance, influencing global data protection practices. As these standards evolve, they set a precedent for privacy and security measures worldwide, prompting organisations to elevate their data governance to meet international expectations.

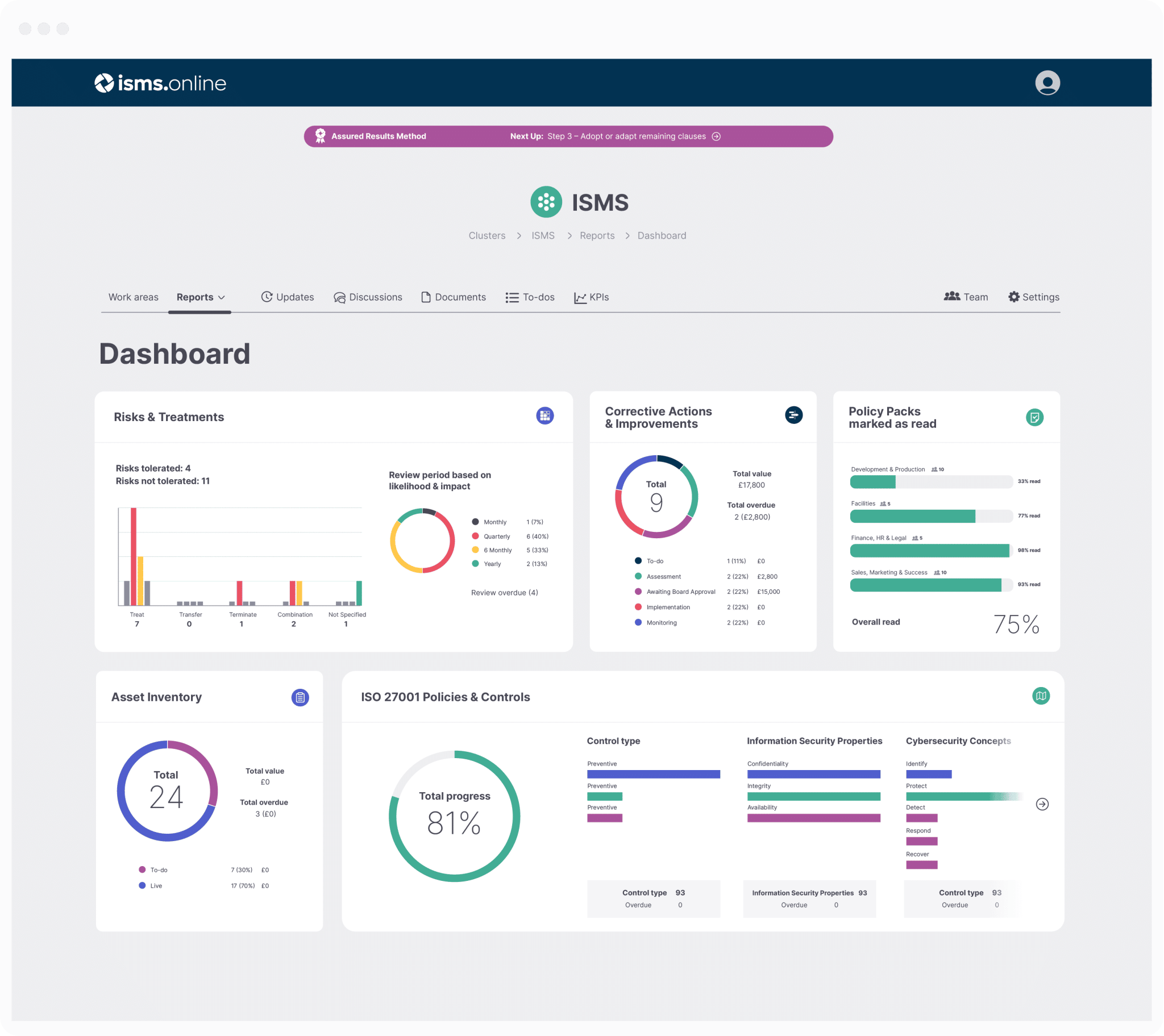

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Security and Privacy in Data Protection

Within the scope of data protection, PCI DSS 4.0 and GDPR are not isolated silos but rather interdependent frameworks that together enhance the security and privacy of consumer information. This synergy is crucial for organisations like yours that handle sensitive data.

Balancing Security with Privacy

PCI DSS 4.0 mandates stringent security measures to safeguard cardholder data, while GDPR enforces the protection of personal data with a strong focus on privacy rights. Together, they create a comprehensive data protection strategy. By implementing PCI DSS’s robust security protocols alongside GDPR’s privacy principles, your organisation can achieve a balanced approach that satisfies both regulations.

Data Minimization: A Shared Compliance Value

Data minimization is a key principle in both PCI DSS 4.0 and GDPR, emphasising the collection and storage of only the necessary data. This practice not only streamlines compliance efforts but also reduces the risk of data breaches and unauthorised access.

Adopting a Privacy-Security Symbiosis

The adoption of a privacy-security symbiosis offers numerous benefits, including enhanced trust from customers and a reduced likelihood of costly data breaches. By leveraging our platform, ISMS.online, you can integrate these principles into your data protection strategies, ensuring that your organisation remains compliant and resilient against threats.

The Costs of a Data Breach and Non-Compliance

Data breaches can have severe financial and reputational repercussions for organisations. Under PCI DSS 4.0 and GDPR, the costs of non-compliance can escalate quickly, not just in terms of monetary fines but also through long-term damage to customer trust and brand integrity.

Financial Repercussions of Data Breaches

The penalties for non-compliance with PCI DSS 4.0 and GDPR can vary significantly:

- PCI DSS 4.0: Fines can range from $5,000 to $100,000 per month until compliance is achieved.

- GDPR: Fines can reach up to 4% of annual global turnover or 20 million, whichever is higher.

Reputational Damage

Beyond fines, a data breach can erode customer confidence and loyalty, which can be far more detrimental to your business in the long run.

Proactive Measures to Mitigate Risks

To avoid these costs, proactive measures are essential:

- Conduct regular risk assessments.

- Implement strong access control measures.

- Maintain up-to-date security protocols.

Using ISMS.online for Data Breach Risk Minimization

At ISMS.online, we understand the importance of safeguarding against data breaches. Our platform offers comprehensive tools and frameworks to help you:

- Stay compliant with both PCI DSS 4.0 and GDPR.

- Implement robust security measures.

- Manage and mitigate risks effectively.

By utilising our services, you can strengthen your organisation’s defence against the high costs associated with data breach non-compliance.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Harmonising Regulatory Standards

In the pursuit of robust data protection, businesses must navigate the confluence of PCI DSS 4.0 and GDPR. These regulations, while distinct in their focus, offer synergistic opportunities for enhancing your organisation’s data security posture.

Identifying Compliance Overlap

Key areas where PCI DSS and GDPR intersect include the stringent requirements for data encryption, access control, and the ongoing monitoring of data processing activities. By focusing on these overlapping areas, your business can create a unified compliance strategy that addresses the core tenets of both standards.

Enhancing Data Security with Encryption and Tokenization

Encryption and tokenization are pivotal in meeting both PCI DSS and GDPR requirements. These technologies serve to obscure sensitive data, rendering it unintelligible to unauthorised parties and thereby reducing the risk of data breaches.

The Critical Role of Risk Assessment

Risk assessments are instrumental in achieving harmonised regulatory compliance. They enable you to identify potential vulnerabilities within your data processing systems and to prioritise security enhancements. Our platform, ISMS.online, provides comprehensive tools to facilitate thorough risk assessments, ensuring that your compliance measures are both proactive and effective.

By leveraging these strategies and tools, you can ensure that your business not only meets regulatory requirements but also builds a foundation of trust with your customers through demonstrable data protection efforts.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Further Reading

The Consequences of Non-Compliance

Understanding the repercussions of non-compliance with PCI DSS 4.0 and GDPR is critical for your organisation. The consequences extend beyond immediate financial penalties and can have a lasting impact on your business’s reputation and customer trust.

Immediate and Long-Term Consequences

Non-compliance with these regulations can result in:

- Substantial fines: For GDPR, up to 4% of annual global turnover or 20 million, and for PCI DSS, fines can range from $5,000 to $100,000 per month until compliance is achieved.

- Long-term reputational damage: Which can lead to a loss of customer confidence and potential revenue.

Differing Notification Requirements

In the event of a data breach, GDPR and PCI DSS have distinct notification requirements:

- GDPR: Requires notification to the relevant supervisory authority within 72 hours of becoming aware of the breach.

- PCI DSS: Mandates that you immediately notify the payment brands and possibly other entities.

Impact on Customer Trust and Business Reputation

A breach of compliance can severely erode customer trust, which is essential for maintaining a positive business reputation. Customers expect their data to be handled securely and responsibly, and failure to comply can lead to a loss of business and customer loyalty.

Ensuring Ongoing Compliance with ISMS.online

At ISMS.online, we provide a comprehensive suite of tools to help you maintain compliance with both PCI DSS 4.0 and GDPR:

- Incident management workflows: To handle any breaches effectively and in accordance with regulatory standards.

- Documentation and evidence management: To demonstrate compliance during audits and reviews.

By utilising our platform, you can safeguard against the risks of non-compliance and protect the integrity of your organisation.

Adapting to Emerging Threats and Regulations

In an ever-evolving digital landscape, future-proofing your compliance strategy is essential. As threats emerge and regulations change, staying ahead is not just about adaptation, but anticipation.

Anticipating GDPR v4.0 Changes

The anticipated changes in GDPR v4.0 will likely bring about stricter privacy controls and enhanced individual rights. These updates may have significant implications for PCI DSS compliance, particularly in areas of data handling and processing.

Staying Ahead of Regulatory Changes

To maintain compliance over time, it’s crucial to:

- Monitor regulatory developments: Stay informed of changes and plan accordingly.

- Educate your team: Ensure that all members understand the implications of new regulations.

- Review and update policies: Regularly revise your data protection policies to align with the latest standards.

ISMS.online: Tools for Evolving Compliance

At ISMS.online, we offer a suite of tools and resources designed to help your organisation stay compliant with evolving standards:

- Adapt, Adopt, Add Framework: To integrate new compliance requirements seamlessly.

- Guided certification processes: To simplify the journey towards compliance.

By leveraging these tools, you can ensure that your compliance framework is robust, resilient, and ready for the future.

Encryption, Tokenization, and Secure Data Practices

As it pertains to data protection, technical safeguards such as encryption and tokenization are not just recommended; they are mandated by standards like PCI DSS 4.0 and GDPR. These technical requirements are critical in safeguarding sensitive data and ensuring compliance.

PCI DSS 4.0 and GDPR: Technical Security Requirements

PCI DSS 4.0 and GDPR set forth specific technical requirements to protect data:

- Data Encryption: Both standards require encryption of sensitive data during transmission and at rest.

- Tokenization: PCI DSS recommends tokenization as a method to minimise the amount of cardholder data in the environment, aligning with GDPR’s data minimisation principle.

Complementary Data Protection Goals

The secure data practices mandated by PCI DSS are designed to complement GDPR’s data protection goals by:

- Enhancing Data Security: Implementing strong encryption and tokenization to protect data integrity and confidentiality.

- Reducing Data Breach Risks: Minimising the potential impact of data breaches through robust security measures.

Best Practices for Technical Security Measures

To satisfy both PCI DSS and GDPR, we recommend the following best practices:

- Regularly Update Encryption Protocols: To counteract emerging threats and vulnerabilities.

- Implement Multi-Layered Security: Including firewalls, intrusion detection systems, and access controls.

Leveraging ISMS.online for Technical Compliance

Our platform, ISMS.online, provides a comprehensive framework to ensure technical compliance with both PCI DSS 4.0 and GDPR:

- Policy Management: To document and manage your encryption and tokenization policies.

- Control Implementation: To help you apply the technical measures required by these standards.

By utilising ISMS.online, you can ensure that your organisation’s data protection measures are robust, up-to-date, and in line with the stringent requirements of PCI DSS 4.0 and GDPR.

Compliance Across Business Operations and Supply Chains

Ensuring that compliance with PCI DSS and GDPR is woven into the fabric of daily operations is a strategic imperative for businesses. It requires a holistic approach where compliance is not an afterthought but a fundamental aspect of business processes.

Challenges in Supply Chain Compliance

The complexity of modern supply chains presents a significant challenge in maintaining compliance. With multiple third-party vendors and service providers, each link in the chain must adhere to the same stringent data protection standards to prevent vulnerabilities.

Maintaining Compliance with Third-Party Vendors

To maintain compliance across third parties, it’s essential to:

- Conduct thorough due diligence before onboarding new vendors.

- Regularly review and update vendor contracts to include compliance obligations.

- Implement ongoing monitoring and auditing of third-party compliance.

Streamlining Compliance with ISMS.online

At ISMS.online, we understand the intricacies of integrating compliance into every aspect of your business. Our platform offers:

- Comprehensive tools: For risk management and compliance tracking.

- Centralised documentation: To maintain a clear record of compliance across your supply chain.

- Collaborative features: Enabling you to work seamlessly with vendors and service providers on compliance-related tasks.

By leveraging our platform, you can ensure that compliance with PCI DSS and GDPR is a consistent and integrated part of your business operations and supply chain management.

Compliance Solutions for PCI DSS and GDPR

At ISMS.online, we understand that each organisation’s compliance journey is unique. That’s why we offer tailored solutions to meet your specific PCI DSS and GDPR compliance needs. Our platform is designed to adapt to your organisation’s size, sector, and the specific challenges you face.

Engaging with ISMS.online for Compliance Assessment

To begin your compliance assessment with ISMS.online, follow these steps:

- Contact Us: Reach out through our website to schedule an initial consultation.

- Needs Analysis: We’ll discuss your current compliance posture and identify areas for improvement.

- Tailored Solution Proposal: Based on our analysis, we’ll propose a customised solution that aligns with your compliance goals.

Enhancing Your Compliance Posture

Partnering with ISMS.online can significantly enhance your organisation’s compliance posture by:

- Providing a centralised platform for managing all compliance-related activities.

- Offering pre-configured templates and frameworks to streamline the compliance process.

- Delivering expert guidance to navigate the complexities of PCI DSS and GDPR.

Ongoing Support and Resources

We are committed to your long-term success and offer ongoing support and resources:- Continuous Updates: Stay informed of regulatory changes with real-time updates.

- Expert Assistance: Access to our team of compliance experts for ongoing support.

- Resource Library: Utilise our extensive library of compliance materials and best practices.

With ISMS.online, you can be confident that your compliance efforts are comprehensive, up-to-date, and aligned with industry standards.