How a PCI DSS Checklist Can Help With Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a global framework designed to secure card transactions and protect cardholder data. As stewards of sensitive payment information, it’s imperative for organisations to adhere to these standards to safeguard against data breaches and maintain consumer trust.

What is PCI DSS and Its Purpose?

PCI DSS stands for Payment Card Industry Data Security Standard. It is a set of security measures that any organisation handling payment card data must implement. The purpose of PCI DSS is to ensure that all sellers, financial institutions, and service providers maintain a secure environment for cardholder information.

The Evolution from Previous Versions to PCI DSS 4.0

PCI DSS 4.0 introduces significant changes that reflect the evolving threat landscape and advancements in technology. Compared to its predecessors, version 4.0 places a stronger emphasis on flexibility and the adoption of new security methodologies to address the complexities of digital payment systems.

The Critical Nature of Compliance with PCI DSS 4.0

Compliance with PCI DSS 4.0 is not just a regulatory requirement; it’s a critical component of your cybersecurity posture. By complying, you’re not only avoiding potential penalties but also reinforcing your organisation’s defence against cyber threats and data breaches.

Enhancements in Payment Card Data Security with PCI DSS 4.0

PCI DSS 4.0 enhances payment card data security by introducing more rigorous and nuanced controls, especially in areas like encryption, authentication, and monitoring. These updates are designed to provide a more resilient framework that adapts to the changing security landscape and the increasing sophistication of cyber-attacks.At ISMS.online, we understand the importance of staying ahead in compliance and security. Our platform is equipped to guide you through the intricacies of PCI DSS 4.0, ensuring that your organisation not only meets but exceeds the standard's requirements.

The Evolution of PCI DSS

As you’re navigating the landscape of PCI DSS 4.0, it’s essential to understand the pivotal changes that set this version apart from its predecessors. At ISMS.online, we’ve distilled the core alterations to ensure you’re equipped with the knowledge to adapt and maintain compliance.

New Requirements in PCI DSS v4.0

PCI DSS 4.0 introduces several new requirements designed to fortify payment security through advanced technology and methodologies:

- Enhanced Authentication Protocols: Strengthening user authentication to protect against unauthorised access.

- Broader Encryption Standards: Expanding encryption requirements for cardholder data across various platforms and technologies.

- Increased Flexibility for Solutions: Allowing customised implementation of controls to address specific security risks.

Impact on the Audit Process

The audit process under PCI DSS 4.0 will now emphasise:

- Customised Approach: Tailoring audits to the organisation’s unique environment and risks.

- Continuous Compliance: Shifting focus from periodic compliance to ongoing security practices.

Implications for Encryption and Access Control

With PCI DSS 4.0, you’ll need to:

- Implement Robust Encryption: Adopt stronger encryption methods for data in transit and at rest.

- Control Access More Tightly: Ensure that access controls are more granular and context-aware.

Adapting to Evolving Threats and Technologies

To keep pace with the dynamic threat landscape, your organisation should:

- Embrace New Technologies: Integrate innovative security solutions that align with PCI DSS 4.0 standards.

- Stay Informed: Keep abreast of emerging threats and update security measures accordingly.

By understanding these key changes, you can better prepare for the transition to PCI DSS 4.0 and ensure that your payment environments are secure and compliant.

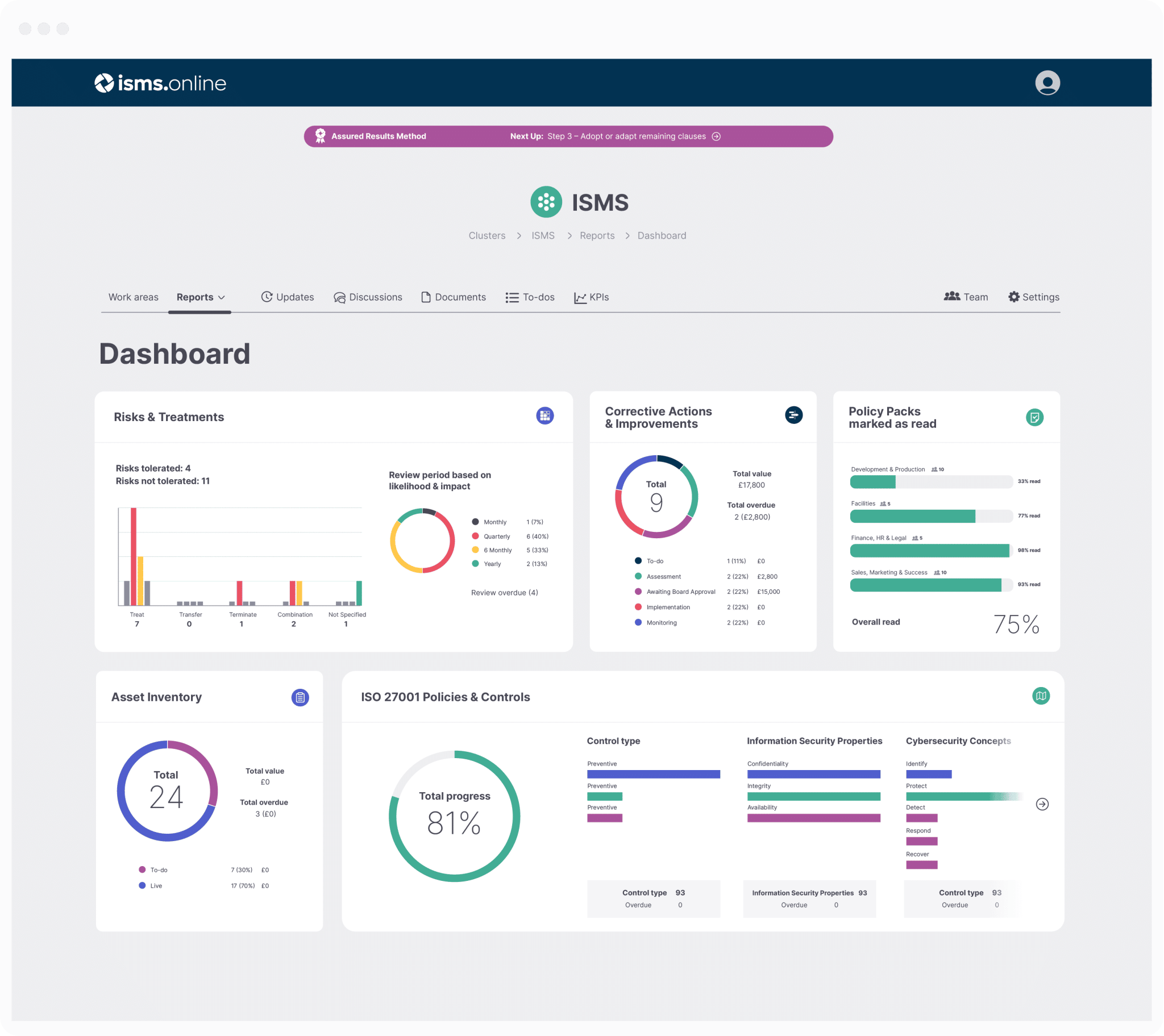

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The 12-Step Compliance Checklist of PCI DSS

Understanding the PCI DSS 4.0 compliance checklist is crucial for your organisation’s security strategy. At ISMS.online, we provide a structured approach to help you navigate these requirements effectively.

Specific Steps in the PCI DSS 4.0 Compliance Checklist

The PCI DSS 4.0 checklist encompasses 12 main requirements, each with its own set of detailed sub-requirements, designed to protect cardholder data:

- Install and Maintain Firewall Configuration

- Do Not Use Vendor-Supplied Defaults

- Protect Stored Cardholder Data

- Encrypt Transmission of Cardholder Data

- Use and Regularly Update Anti-Virus Software

- Develop and Maintain Secure Systems and Applications

- Restrict Access to Cardholder Data by Business Need-to-Know

- Assign a Unique ID to Each Person with Computer Access

- Restrict Physical Access to Cardholder Data

- Track and Monitor All Access to Network Resources and Cardholder Data

- Regularly Test Security Systems and Processes

- Maintain a Policy That Addresses Information Security

Integrating the 300+ Sub-Requirements

The 300+ sub-requirements are integral to the compliance process, providing:

- Granular Guidance: Detailed instructions for implementing each main requirement.

- Contextual Relevance: Specific actions tailored to different organisational environments.

Strategies for Holistic Security

To ensure holistic security, organisations should:

- Conduct Thorough Risk Assessments: Identify and mitigate potential vulnerabilities.

- Implement Layered Security Measures: Combine multiple security controls to protect data.

Cost Reduction and Attack Prevention

Compliance with the PCI DSS 4.0 checklist aids in:

- Minimising Financial Risks: Reducing the likelihood of costly data breaches.

- Enhancing Reputation: Building trust with customers by demonstrating a commitment to security.

By adhering to these steps, you can fortify your defences, streamline compliance efforts, and safeguard your organisation’s and customers’ sensitive data.

PCI DSS and Access Control

Within the scope of payment security, access control is a cornerstone of PCI DSS 4.0. Our platform at ISMS.online emphasises the importance of robust access control mechanisms to safeguard sensitive cardholder data effectively.

Implementing Robust Access Controls

Access control within PCI DSS 4.0 is multifaceted, involving both digital and physical measures:

- Systematic Access Management: Ensuring that access to system components is on a need-to-know basis.

- Authentication Protocols: Deploying strong authentication methods to verify the identity of users accessing the system.

Multi-Factor Authentication and Unique User IDs

PCI DSS 4.0 mandates the use of multi-factor authentication (MFA) and unique user IDs to enhance security:

- MFA: An additional layer of security that requires two or more verification methods.

- Unique User IDs: Ensuring each individual has a distinct digital identity, preventing unauthorised sharing of credentials.

The Role of Physical Access Control

Physical access control remains an essential aspect of PCI DSS 4.0:

- Entry Point Security: Implementing measures such as card readers, biometrics, and surveillance to restrict physical access to sensitive areas.

- Visitor Management: Logging and monitoring the entry and exit of visitors to prevent unauthorised access to cardholder data environments.

By integrating these access control measures, you’re not only aligning with PCI DSS 4.0 but also fortifying your payment ecosystem against potential security breaches.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Encryption in PCI DSS Compliance

Encryption is a critical component of PCI DSS 4.0, serving as a robust safeguard for cardholder data. At ISMS.online, we understand the complexities of encryption and are committed to guiding you through the requirements to ensure your organisation’s compliance.

Addressing Cardholder Data Encryption

PCI DSS 4.0 requires encryption of cardholder data both at rest and in transit:

- At Rest: Data stored in databases, files, or other storage methods must be encrypted.

- In Transit: Data moving through networks must be protected using strong encryption protocols.

Encryption Key Management and Data Protection

Effective key management is essential for maintaining the integrity of encryption practices:

- Key Storage: Securely store encryption keys separate from the encrypted data.

- Key Rotation: Regularly change encryption keys to minimise the risk of compromise.

Ensuring Up-to-Standard Encryption Protocols

To align with PCI DSS 4.0 standards, your organisation should:

- Use Approved Algorithms: Employ encryption algorithms that are recognised as secure and robust.

- Conduct Regular Assessments: Evaluate and update encryption methods to address new vulnerabilities.

Overcoming Challenges with Public Network Encryption

Encrypting data on public networks presents unique challenges:

- Use Strong Cryptography: Implement industry-standard cryptographic protocols like TLS for data transmission.

- Monitor and Update: Continuously monitor public network encryption and update practices as needed to counter emerging threats.

By prioritising encryption and adhering to these guidelines, you can ensure that your organisation’s handling of cardholder data is secure and compliant with PCI DSS 4.0.

Implementing and Maintaining Security Measures

Ensuring the security of cardholder data is a continuous process that requires diligent implementation and maintenance of various protective measures. As part of our services at ISMS.online, we guide you through the critical security controls mandated by PCI DSS 4.0.

Firewall Installation and Maintenance

Firewalls are your first line of defence in protecting your network:

- Installation: Deploy firewalls that conform to industry standards and are configured to protect cardholder data effectively.

- Maintenance: Regularly update firewall rules to respond to new threats and ensure they remain effective.

Secure System and Application Deployment

Secure deployment of systems and applications is non-negotiable:

- Development: Integrate security into the software development lifecycle.

- Patching: Apply patches promptly to address known vulnerabilities.

Antivirus Requirements and Malware Defence

Staying ahead of malware is a dynamic challenge:

- Antivirus Software: Deploy and regularly update antivirus solutions on all systems commonly affected by malware.

- Malware Strategies: Develop and maintain strategies to identify and mitigate the evolving threat of malware.

Continuous Monitoring and Testing Protocols

PCI DSS 4.0 emphasises the importance of ongoing vigilance:

- Monitoring: Implement continuous monitoring mechanisms to detect unauthorised activity.

- Testing: Regularly test security systems to ensure they are functioning correctly and effectively.

By adhering to these guidelines, you can establish a robust security posture that aligns with PCI DSS 4.0 and protects your organisation’s valuable data assets.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Preparing for a PCI DSS 4.0 Audit

Preparing for a PCI DSS 4.0 audit can be a complex process, but with a structured approach, you can navigate it with confidence. At ISMS.online, we provide the guidance you need to ensure your organisation is ready for the audit.

Documentation and Network Diagrams

Accurate documentation is key to a successful PCI DSS audit:

- Inventory of Assets: List all components involved in the processing, storage, or transmission of cardholder data.

- Network Diagrams: Create comprehensive diagrams that detail the flow of cardholder data across your network.

Engaging with a Qualified Security Assessor (QSA)

A QSA plays a pivotal role in the audit process:

- Selection: Choose a QSA with experience relevant to your industry and specific business environment.

- Collaboration: Work closely with your QSA to understand the scope of the audit and prepare accordingly.

Steps for Remediation

Addressing gaps in compliance is essential:

- Identify Issues: Use the QSA’s findings to pinpoint areas that require remediation.

- Plan Remediation: Develop a clear plan to address each issue, assigning responsibilities and timelines.

Report on Compliance (ROC) Submission

The ROC is a critical component of the audit:

- Compile Evidence: Gather all necessary documentation that demonstrates compliance with PCI DSS 4.0.

- Complete the ROC: Accurately fill out the ROC with the assistance of your QSA.

- Submit: Provide the ROC to your acquiring bank and card brands as required.

By following these steps, you can prepare for your PCI DSS 4.0 audit with a clear understanding of the requirements and a plan for achieving compliance.

Further Reading

SIEM and Cloud Solutions for Compliance

In the context of PCI DSS 4.0, technology plays a pivotal role in ensuring compliance.

The Support of SIEM in PCI DSS 4.0 Compliance

SIEM systems are instrumental in meeting PCI DSS 4.0 requirements:

- Real-Time Monitoring: They provide continuous surveillance of your network, detecting potential security incidents as they occur.

- Log Management: SIEM tools aggregate and analyse logs from various sources, ensuring that all access to cardholder data is recorded and auditable.

- Alerting and Reporting: Automated alerts and comprehensive reports generated by SIEM facilitate prompt response to threats and streamline compliance reporting.

Benefits of Cloud Solutions like Exabeam Fusion SIEM

Cloud-based SIEM solutions offer several advantages:

- Scalability: Easily adjust your security measures to handle fluctuating data volumes and evolving threats.

- Cost-Effectiveness: Reduce the need for on-premises hardware and associated maintenance costs.

- Accessibility: Access your security data and insights from anywhere, fostering a proactive security approach.

Securing Cloud Architecture to Meet PCI DSS 4.0 Standards

When utilising cloud services, it’s essential to:

- Conduct Regular Reviews: Periodically assess your cloud architecture to ensure it aligns with PCI DSS 4.0 controls.

- Implement Robust Encryption: Protect data in the cloud with strong encryption methods during storage and transmission.

Considerations for Data Security and Risk Assessment

In cloud environments, a thorough risk assessment is crucial:

- Identify Vulnerabilities: Continuously scan for security gaps that could be exploited.

- Data Governance: Establish clear policies for data access, processing, and storage in the cloud.

By leveraging SIEM and cloud technologies, you can enhance your compliance efforts and maintain a strong defence against security threats.

Training and Policy Development

Creating a culture of security within your organisation is a fundamental step towards PCI DSS 4.0 compliance. At ISMS.online, we emphasise the importance of comprehensive employee training and robust policy development.

The Importance of Employee Training

Employee training is the bedrock of a secure environment:

- Awareness: It ensures that all staff members are aware of the security risks and the importance of protecting cardholder data.

- Best Practices: Training equips your team with the knowledge to follow best practices and recognise potential threats, such as phishing attempts.

Developing a Comprehensive Information Security Policy

A well-crafted information security policy sets the standard for your organisation’s approach to security:

- Clarity: It should clearly define roles, responsibilities, and expected behaviours regarding data security.

- Relevance: The policy must be relevant to the current threat landscape and compliant with PCI DSS 4.0 requirements.

Components of Effective Security Awareness Training

Key elements of security training include:

- Phishing Detection: Teach employees to identify and respond to phishing attempts.

- Password Management: Instruct on creating strong passwords and the importance of regular updates.

- Incident Reporting: Ensure staff knows how to report security incidents promptly.

Leadership’s Role in Fostering Compliance

Leadership must lead by example to foster a culture of compliance:

- Communication: Maintain open lines of communication regarding security policies and updates.

- Support: Provide continuous support for security initiatives and training programmes.

By prioritising these aspects, you’re not only preparing for PCI DSS 4.0 compliance but also investing in the long-term security and resilience of your organisation.

The Strategic Advantage of PCI DSS 4.0

Achieving compliance with PCI DSS 4.0 is not just a regulatory necessity; it’s a strategic move that can enhance your organisation’s reputation and competitive edge. At ISMS.online, we help you understand the broader benefits of compliance and how it can be a catalyst for business growth.

Building Payment Confidence and Data Protection

Compliance with PCI DSS 4.0 is pivotal in establishing trust with your customers:

- Consumer Trust: Demonstrating adherence to the latest security standards reassures customers that their data is protected.

- Data Integrity: Robust encryption and access controls ensure the integrity and confidentiality of payment information.

Holistic Approach to Security

Adopting a holistic approach to PCI DSS 4.0 offers long-term security benefits:

- Comprehensive Coverage: Addressing all aspects of data security, from physical to digital, minimises vulnerabilities.

- Future-Proofing: Preparing for emerging threats by staying ahead of security trends ensures ongoing protection.

Leveraging Compliance as a Market Differentiator

PCI DSS 4.0 compliance can set you apart in the marketplace:

- Brand Strength: It positions your brand as a leader in security, potentially attracting more customers.

- Market Confidence: Compliance signals to partners and stakeholders that you’re a reliable entity in handling sensitive data.

Mitigating the Risks of Non-Compliance

Understanding the consequences of non-compliance is crucial:

- Avoiding Penalties: Non-compliance can result in fines, penalties, and increased scrutiny from regulators.

- Reputation Management: Proactive compliance efforts help prevent data breaches that could damage your organisation’s reputation.

By embracing PCI DSS 4.0 compliance, you’re not only fulfilling a requirement but also investing in the security and success of your business.

Integrating PCI DSS with Other Regulatory Frameworks

Navigating the complex landscape of compliance standards can be daunting. At ISMS.online, we understand the intricacies of aligning PCI DSS 4.0 with other regulatory frameworks like GDPR and are here to streamline this process for you.

Overlapping Compliance with GDPR

PCI DSS 4.0 and GDPR share common ground in data protection:

- Data Encryption: Both standards require robust encryption to safeguard sensitive information.

- Access Controls: They emphasise the need for stringent access controls to prevent unauthorised data access.

Efficiencies in Simultaneous Adoption

Adopting PCI DSS 4.0 alongside other regulations can yield significant efficiencies:

- Unified Approach: Implementing overlapping controls can satisfy multiple compliance requirements simultaneously.

- Resource Optimization: Streamlining efforts can reduce the need for separate audits and assessments, saving time and resources.

Streamlining Compliance with ISMS.online

Our platform facilitates a cohesive compliance strategy:

- Integrated Frameworks: ISMS.online offers tools to manage compliance with PCI DSS 4.0 and other standards within a single system.

- Automated Workflows: We provide automated workflows to ensure all compliance activities are tracked and documented.

Challenges in Compliance Alignment

While integrating PCI DSS 4.0 with other standards, organisations may face challenges:

- Varying Requirements: Different standards may have unique requirements that need to be reconciled.

- Continuous Updates: Keeping up with the evolving landscape of compliance standards requires vigilance and adaptability.

By leveraging ISMS.online, you can overcome these challenges and ensure a comprehensive and efficient approach to compliance.

Contact ISMS.online to Achieve PCI DSS Compliance

Embarking on the journey to PCI DSS 4.0 compliance can be streamlined with the right partner. At ISMS.online, we are dedicated to assisting your organisation through this intricate process.

How ISMS.online Facilitates PCI DSS 4.0 Compliance

Our platform offers comprehensive support for your compliance needs:

- Integrated Management System: Simplify the compliance process with our all-in-one platform that aligns with PCI DSS 4.0 requirements.

- Continuous Improvement Tools: Utilise our dynamic tools designed for ongoing compliance management and improvement.

Support and Resources Offered by ISMS.online

We provide a wealth of resources to guide you:

- Expert Guidance: Our team of compliance experts is available to support you through each step of the PCI DSS 4.0 audit checklist.

- Documentation Templates: Access a range of templates that help streamline the creation of necessary documentation for compliance.

Benefits of Our Integrated Management System

Leveraging our Integrated Management System offers significant advantages:

- Efficiency: Coordinate all compliance efforts in one place, reducing duplication and saving time.

- Clarity: Gain clear visibility into your compliance status with our intuitive dashboard and reporting tools.

Next Steps on Your Compliance Journey

Ready to take the next step?Contact ISMS.online today to ensure your organisation's smooth transition to PCI DSS 4.0 compliance.