What is PCI DSS Certification?

The Payment Card Industry Data Security Standard (PCI DSS) represents a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. This standard is important for businesses handling cardholder data to protect against data breaches and fraud.

What is the Payment Card Industry Data Security Standard?

PCI DSS is a global standard that provides a baseline of technical and operational requirements designed to protect cardholder data. It was established to help facilitate the broad adoption of consistent data security measures.

Why is PCI DSS Certification Essential for Businesses Handling Cardholder Data?

For businesses involved in the payment card industry, PCI DSS certification is essential. It not only helps in safeguarding sensitive cardholder information but also builds trust with customers, affirming that their data is protected.

When Did PCI DSS Certification Become a Requirement for Payment Card Industry Entities?

PCI DSS was introduced in 2004 by the major credit card companies as a unified approach to safeguarding cardholder information for all types of transactions. The standard has evolved over time to address emerging threats and technologies.

How Does the PCI DSS Certification Process Work?

The certification process involves assessing the current payment card processing environment against the PCI DSS standards, identifying any gaps, and implementing necessary security measures to comply. This process is continuous, requiring regular monitoring and testing to ensure ongoing compliance.Understanding PCI DSS Compliance Levels

Navigating the Payment Card Industry Data Security Standard (PCI DSS) compliance landscape requires an understanding of its structured compliance levels. These levels are designed to categorise businesses based on the volume of card transactions they process, tailoring the compliance requirements to the scale of operation and associated risk.

What Are the Different PCI DSS Compliance Levels?

PCI DSS compliance is categorised into four levels, ranging from Level 1, for entities processing over 6 million card transactions annually, to Level 4, for those handling fewer than 20,000 transactions. Each level dictates specific validation and reporting requirements to ensure secure handling of cardholder data.

Determining a Business’s Compliance Level

Your business’s compliance level is determined by the total number of card transactions processed annually across all channels. This includes both credit and debit card transactions. It’s essential to accurately calculate this volume to understand your compliance obligations.

The Rationale Behind Different Levels of Compliance

The tiered approach to compliance levels allows for a risk-based assessment of security needs. Higher transaction volumes typically present a greater risk of data breaches, thus necessitating more stringent compliance measures for higher-level entities.

Impact of Compliance Levels on the Certification Process

The compliance level of your business directly influences the validation process required for PCI DSS certification. Level 1 entities must undergo an annual Report on Compliance (ROC) by a Qualified Security Assessor (QSA), while Levels 2 to 4 may be eligible for a Self-Assessment Questionnaire (SAQ). Understanding your compliance level is required for navigating the certification process efficiently.

At ISMS.online, we provide guidance and support to help you determine your PCI DSS compliance level and navigate the certification process, ensuring that your business meets all necessary security standards.

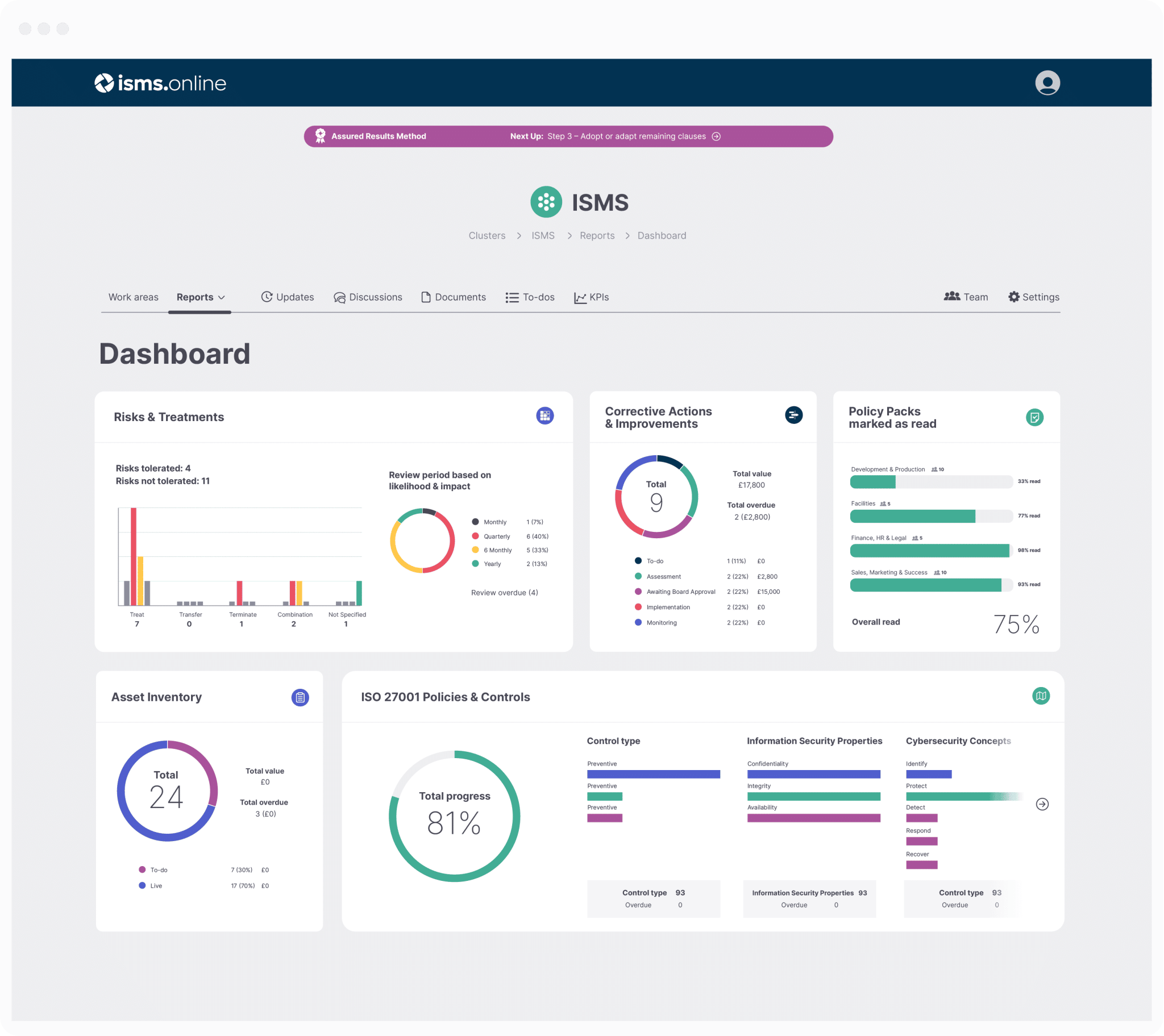

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The 12 Requirements of PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) establishes a framework of 12 requirements designed to secure cardholder data and protect against fraud. Understanding these requirements is essential for any business that processes, stores, or transmits credit card information.

Specific Requirements for Compliance

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data through encryption and other measures.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update antivirus software or programmes.

- Develop and maintain secure systems and applications by applying necessary patches and updates.

- Restrict access to cardholder data by business need-to-know.

- Assign a unique ID to each person with computer access to track user activities.

- Restrict physical access to cardholder data to prevent unauthorised access.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes to identify vulnerabilities.

- Maintain a policy that addresses information security for all personnel.

Ensuring the Security of Cardholder Data

Each requirement plays a critical role in forming a comprehensive security posture. For instance, encrypting data transmission helps prevent unauthorised interception, while regular testing of security systems ensures that vulnerabilities are promptly identified and addressed.

Meeting the Requirements Effectively

Businesses can meet these requirements by implementing robust security measures and maintaining vigilance in their security practices. At ISMS.online, we offer tools and guidance to help you establish and maintain compliance with PCI DSS, ensuring that your business not only meets but exceeds these essential security standards.

Role of the PCI Security Standards Council

The PCI Security Standards Council (PCI SSC) plays a pivotal role in the Payment Card Industry Data Security Standard (PCI DSS) ecosystem. As the governing body, it is responsible for the development, enhancement, storage, dissemination, and implementation of security standards for the protection of cardholder data.

Who Governs the PCI DSS Standards?

The PCI SSC was founded by major credit card companies, including Visa, MasterCard, American Express, Discover, and JCB. It governs the PCI DSS standards to ensure a unified and comprehensive approach to protecting cardholder data across the global payment card industry.

The Council’s Role in the Certification Process

The PCI SSC does not directly manage the certification process for individual organisations. Instead, it establishes the standards and frameworks that Qualified Security Assessors (QSAs) and businesses must follow to achieve and maintain compliance. The council also accredits QSAs and Approved Scanning Vendors (ASVs) who play a direct role in the certification process.

Updating and Enforcing PCI DSS Standards

The PCI SSC is tasked with the continuous update of PCI DSS standards to address emerging threats and technologies. It enforces compliance through a structured framework that requires periodic validation of adherence to the standards, typically on an annual basis.

Importance of the Council’s Guidance

For businesses seeking PCI DSS certification, the guidance provided by the PCI SSC is invaluable. It offers a wealth of resources, including detailed standards documents, self-assessment questionnaires, and best practices for securing cardholder data. Adhering to the council’s guidance ensures that businesses implement the most effective and up-to-date security measures.

At ISMS.online, we understand the importance of staying aligned with the PCI SSC’s standards and guidance. Our platform is designed to help you navigate the complexities of PCI DSS compliance, ensuring that your business meets the rigorous requirements set forth by the council.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Steps to Achieve PCI DSS Certification

Embarking on the journey to PCI DSS certification requires a structured approach to ensure that all aspects of the standard are comprehensively addressed. Here, we outline the key steps involved in achieving certification and how ISMS.online can support your business throughout this process.

Initiating the Certification Process

The first step towards PCI DSS certification involves understanding your organisation’s current security posture and compliance requirements. This includes determining your compliance level based on transaction volumes and identifying the scope of the assessment.

Conducting a Gap Analysis

A thorough gap analysis is necessary to identify areas where your current security practices do not meet PCI DSS requirements. This analysis provides a roadmap for the implementation of necessary controls and security measures.

Implementing Required Controls

Following the gap analysis, the next step is to implement the required security controls and processes. This includes configuring firewalls, encrypting data transmissions, and establishing access controls, among other measures.

Engaging in Continuous Monitoring and Improvement

PCI DSS compliance is not a one-time event but a continuous process of monitoring, testing, and improving your security posture. Regularly reviewing and updating security measures ensures ongoing compliance and protection of cardholder data.

How ISMS.online Can Assist

At ISMS.online, we offer a comprehensive platform that simplifies the PCI DSS certification process. Our tools and templates help you conduct gap analyses, manage documentation, and track the implementation of controls. Our platform also facilitates continuous monitoring and improvement, making it easier for your business to maintain compliance.

By following these structured steps and leveraging the support of ISMS.online, your business can navigate the path to PCI DSS certification with confidence, ensuring the security of cardholder data and compliance with industry standards.

Cybersecurity Measures for PCI DSS Compliance

Achieving and maintaining PCI DSS compliance necessitates the implementation of robust cybersecurity measures. These measures are designed to protect cardholder data against unauthorised access and evolving cyber threats.

Mandatory Cybersecurity Measures

For PCI DSS compliance, several cybersecurity measures are mandatory:

- Encryption: Protects data in transit and at rest, ensuring that even if data is intercepted, it remains unreadable without the proper decryption keys.

- Antivirus Software: Serves as a fundamental defence mechanism against malware and viruses that could compromise cardholder data.

- Firewalls: Act as a barrier between your secure internal network and untrusted external networks, such as the internet.

Protection Against Evolving Threats

The cyber threat landscape is constantly evolving, with new vulnerabilities emerging regularly. Implementing the aforementioned cybersecurity measures provides a solid foundation for protecting against these threats. Regular updates and patches are essential to address new vulnerabilities as they are discovered.

The Importance of Continuous Cybersecurity Vigilance

Continuous vigilance in cybersecurity practices is essential for maintaining PCI DSS compliance. This includes regular monitoring of security systems, conducting security assessments, and staying informed about the latest cyber threats and trends.

Contribution of Encryption, Antivirus Software, and Firewalls to Compliance

- Encryption ensures that sensitive data is always protected, both during transmission over networks and when stored.

- Antivirus software helps in detecting and mitigating malware that could compromise or steal cardholder data.

- Firewalls control the traffic between the secure internal network and external sources, preventing unauthorised access to cardholder data.

At ISMS.online, we understand the critical role these cybersecurity measures play in achieving PCI DSS compliance. Our platform provides the tools and guidance necessary to implement and manage these security measures effectively, ensuring your organisation remains compliant and your customers’ data stays secure.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Risk Assessment and Vulnerability Management

Risk assessment and vulnerability management are integral components of the PCI DSS certification process. They serve as proactive measures to identify and mitigate potential security threats to cardholder data. Understanding these processes and their importance can significantly enhance your organisation’s security posture.

How Risk Assessment Fits into the PCI DSS Certification Process

Risk assessment is the first step in identifying vulnerabilities within your payment card processing environment. It involves evaluating your systems and processes to identify potential security weaknesses that could be exploited by cybercriminals. This assessment is required for determining the scope of your PCI DSS compliance efforts and for prioritising the implementation of security measures.

Best practices for Vulnerability Management

Effective vulnerability management includes:

- Regular Scanning: Conducting periodic scans of your systems to identify vulnerabilities.

- Patch Management: Promptly applying patches to fix identified vulnerabilities.

- Documentation: Keeping detailed records of identified risks and the measures taken to mitigate them.

These practices ensure that potential security threats are identified and addressed promptly, reducing the risk of data breaches.

The Critical Role of Regular Testing and Patch Management

Regular testing and patch management are essential for maintaining the security of cardholder data. They help in identifying new vulnerabilities and ensuring that the implemented security measures remain effective over time. Regular updates and patches are necessary to protect against evolving cyber threats.

Utilising Automated Tools for Risk Identification and Mitigation

Automated tools can significantly streamline the risk assessment and vulnerability management processes. They can perform continuous scans, identify vulnerabilities in real-time, and sometimes even apply necessary patches automatically. utilising these tools can enhance your organisation’s ability to protect against security threats efficiently.

At ISMS.online, we understand the complexities involved in risk assessment and vulnerability management. Our platform offers tools and resources to help you conduct thorough risk assessments and manage vulnerabilities effectively, ensuring your organisation remains compliant with PCI DSS requirements.

Further Reading

Compliance Monitoring and Reporting

Ensuring adherence to the Payment Card Industry Data Security Standard (PCI DSS) is an ongoing process that requires diligent monitoring and accurate reporting. Understanding the requirements for compliance monitoring and the frequency of validation and reporting is important for maintaining the trust of stakeholders and ensuring the security of cardholder data.

Requirements for Compliance Monitoring and Reporting

PCI DSS mandates continuous monitoring of security controls and processes to ensure they are effective and compliant. This includes regular reviews of security systems, access controls, and the effectiveness of implemented security measures. Reporting, on the other hand, involves documenting the findings from these monitoring activities and demonstrating compliance through required documentation such as the Report on Compliance (ROC) or Self-Assessment Questionnaire (SAQ).

Frequency of Compliance Validation and Reporting

The frequency of compliance validation and reporting depends on your organisation’s compliance level. For most businesses, annual validation through an SAQ or ROC is required, along with quarterly network scans by an Approved Scanning Vendor (ASV). It’s essential to adhere to these timelines to maintain compliance status.

The Importance of Transparent Reporting for Stakeholders

Transparent reporting is vital for building and maintaining trust with stakeholders, including customers, partners, and regulatory bodies. It demonstrates your commitment to protecting cardholder data and provides assurance that you are meeting industry standards.

How ISMS.online Facilitates Compliance Reporting and Evidence Collection

At ISMS.online, we understand the complexities of PCI DSS compliance monitoring and reporting. Our platform simplifies these processes by providing tools for effective evidence collection, documentation management, and reporting. With ISMS.online, you can streamline your compliance efforts, ensuring that monitoring activities are accurately recorded and reports are generated efficiently, making the compliance process more manageable for your organisation.

Addressing Common PCI DSS Certification Challenges

Achieving PCI DSS certification can be a complex process, fraught with challenges that can hinder an organisation’s path to compliance. Understanding these challenges and knowing how to navigate them is important for a smooth certification journey.

Common Challenges in Achieving PCI DSS Certification

Businesses often face several hurdles during the PCI DSS certification process, including:

- Scope Determination: Accurately defining the scope of the PCI DSS assessment can be difficult, leading to either an overly broad scope that complicates compliance efforts or an overly narrow scope that leaves vulnerabilities unaddressed.

- Resource Allocation: Allocating sufficient resources, both in terms of budget and personnel, to meet the stringent requirements of PCI DSS.

- Keeping Up with Evolving Standards: PCI DSS standards are regularly updated to counter new threats, requiring businesses to stay informed and adapt their compliance strategies accordingly.

Overcoming Certification Challenges

To overcome these challenges:

- Engage Experts: Consider consulting with Qualified Security Assessors (QSAs) or utilising platforms like ISMS.online that offer guidance and tools tailored to PCI DSS compliance.

- Comprehensive Planning: Develop a detailed plan that includes scope determination, resource allocation, and a timeline for compliance activities.

- Continuous Education: Stay informed about the latest PCI DSS versions and best practices through resources provided by the PCI Security Standards Council and other reputable sources.

The Importance of Anticipating Obstacles

Anticipating potential obstacles allows for proactive measures to be put in place, reducing the likelihood of delays or failures in achieving certification. It ensures that your organisation is well-prepared to address any issues that may arise during the certification process.

Staying Updated with PCI DSS Versions

Regularly updating your compliance programme to align with the latest PCI DSS versions is essential for addressing new and evolving security threats. It not only helps in maintaining compliance but also enhances the overall security posture of your organisation.

At ISMS.online, we understand the challenges you face in achieving PCI DSS certification. Our platform is designed to support you through every step of the process, offering tools and resources that simplify compliance and help you stay up to date with the latest standards.

The Importance of Third-Party Risk Management

In the realm of PCI DSS certification, the security of your supply chain and third-party vendors is not just an extension of your compliance effortsit’s a fundamental component. Understanding how third-party risk management impacts PCI DSS certification, and employing effective strategies for vendor compliance, is crucial for safeguarding cardholder data across all touchpoints.

Impact on PCI DSS Certification

Third-party risk management is critical because vendors and partners who handle cardholder data on your behalf must also comply with PCI DSS standards. A breach in their systems can directly impact your compliance status and security posture. Ensuring that all entities in your payment processing ecosystem adhere to PCI DSS is not optionalit’s a necessity.

Strategies for Ensuring Vendor Compliance

- Due Diligence: Conduct thorough assessments of vendors’ security practices and PCI DSS compliance status before engagement.

- Contractual Agreements: Include specific clauses in contracts that mandate compliance with PCI DSS and outline the responsibilities of each party.

- Regular Audits: Perform regular audits of third-party vendors to ensure ongoing compliance and address any gaps promptly.

Criticality of Supply Chain Security

The security of the supply chain becomes obligatory because vulnerabilities in any part of the chain can expose the entire ecosystem to risks. A single weak link can lead to data breaches, resulting in financial losses, reputational damage, and regulatory penalties.

Effective Management of Third-Party Risks

To effectively manage third-party risks, it’s essential to:

- Implement a Vendor Management programme: Establish a structured programme for managing vendor relationships, including regular reviews and risk assessments.

- Educate and Train Vendors: Provide resources and training to vendors on PCI DSS requirements and best practices for data security.

- Monitor and Review: Continuously monitor vendors’ compliance status and review their security measures to ensure they align with your organisation’s standards.

At ISMS.online, we understand the complexities of managing third-party risks in the context of PCI DSS certification. Our platform offers tools and resources to streamline vendor assessments, manage contracts, and ensure that your entire supply chain meets the stringent requirements of PCI DSS. By partnering with us, you can enhance your third-party risk management efforts and maintain a robust security posture across your payment processing ecosystem.

Advanced Security Measures and Technologies

In the pursuit of PCI DSS compliance, adopting advanced security measures and technologies is imperative. These measures not only fortify your defences against cyber threats but also ensure the integrity and confidentiality of cardholder data.

End-to-End Encryption and Tokenization

End-to-end encryption (E2EE) ensures that data transmitted across networks is encrypted from the source to the destination, making it inaccessible to unauthorised parties. Tokenization replaces sensitive data elements with non-sensitive equivalents, known as tokens, which have no exploitable value. Together, these technologies significantly reduce the risk of data breaches and enhance data security.

Importance of Application Layer Firewalls, IDS, and IPS

Application layer firewalls provide a robust security layer that scrutinises traffic to and from applications, blocking malicious traffic and preventing unauthorised access. Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS) monitor network and system activities for malicious actions or policy violations, offering real-time protection against threats. These technologies are crucial for safeguarding network security and ensuring compliance with PCI DSS requirements.

Support from ISMS.online

While ISMS.online is not a cybersecurity platform, it plays a important role in supporting the implementation of advanced security measures. Our platform offers comprehensive tools for managing and documenting your compliance efforts, including the integration of security technologies. With ISMS.online, you can streamline your compliance processes, maintain accurate records of your security measures, and ensure that your organisation adheres to PCI DSS standards.

ISMS.online Offers PCI DSS Certification Support

Navigating the complexities of PCI DSS certification can be challenging. At ISMS.online, we are dedicated to assisting your business in achieving and maintaining PCI DSS compliance with ease and efficiency.

How ISMS.online Can Assist Your Business

Our platform offers a comprehensive suite of tools designed to simplify the PCI DSS compliance process. From initial gap analysis to continuous monitoring and reporting, we provide everything you need to ensure your business meets all PCI DSS requirements. Our solutions are tailored to support businesses of all sizes, making compliance achievable for everyone.

Services and Tools Offered by ISMS.online

- Guided Compliance Frameworks: Navigate the PCI DSS certification process with structured frameworks that outline each step of compliance.

- Risk Management Tools: Identify, assess, and mitigate risks associated with cardholder data to maintain a robust security posture.

Why Choose ISMS.online for Your PCI DSS Compliance Needs

Choosing ISMS.online means partnering with experts who understand the intricacies of PCI DSS compliance. Our platform is designed to make the certification process as straightforward as possible, allowing you to focus on your core business operations while we handle the complexities of compliance.