How Can You Implement PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) serves as a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. This standard is not just a recommendation but a mandate for organisations handling cardholder data.

What is PCI DSS and Its Importance?

PCI DSS is a global standard that provides a baseline of technical and operational requirements designed to protect cardholder data. The importance of PCI DSS lies in its role in the prevention of data breaches and fraud, ensuring that sensitive cardholder information is secure.

Who Needs to Comply?

All entities involved in the processing, storage, or transmission of cardholder data are required to comply with PCI DSS standards. This includes merchants of all sizes, payment gateways, processors, and service providers, regardless of the volume of transactions they process.

Starting the Compliance Process

The compliance process should begin as soon as an organisation starts handling cardholder data. Early adoption of PCI DSS measures can significantly reduce the risk of data breaches and the associated costs.

Benefits of PCI DSS Compliance

Compliance with PCI DSS not only helps in protecting sensitive cardholder data but also enhances an organisation's reputation by demonstrating a commitment to security. Trust is a critical component in customer relationships, and PCI DSS compliance can significantly contribute to building and maintaining this trust.Understanding PCI DSS Compliance Levels

Navigating the Payment Card Industry Data Security Standard (PCI DSS) compliance landscape requires a clear understanding of the various compliance levels and their implications for your organisation. These levels are determined primarily by transaction volume, influencing the rigour and scope of the compliance requirements you must meet.

Determining Your Compliance Level

PCI DSS compliance is categorised into four levels, based on the annual transaction volume across all channels. The classification ranges from Level 1, for merchants processing over 6 million Visa or MasterCard transactions per year, to Level 4, for those processing fewer than 20,000 Visa or MasterCard e-commerce transactions annually. It’s imperative to accurately identify your organisation’s level, as this dictates the specific validation requirements and assessment procedures you need to follow.

The Role of Transaction Volume

Transaction volume plays a pivotal role in determining your compliance level. Higher transaction volumes imply a greater risk of data breaches, thus necessitating more stringent compliance measures. Understanding how your transaction volume affects your compliance level is mandatory for implementing the appropriate security controls and measures.

Resources for Compliance Officers

For compliance officers seeking to ascertain their organisation’s PCI DSS compliance level, resources are available through the official PCI Security Standards Council (PCI SSC) website. Here, you can find comprehensive guidelines and tools designed to assist in determining your compliance level. Additionally, our platform, ISMS.online, offers tailored support and resources to streamline your compliance journey, ensuring you have access to the necessary information and tools to accurately identify and maintain your compliance level effectively.

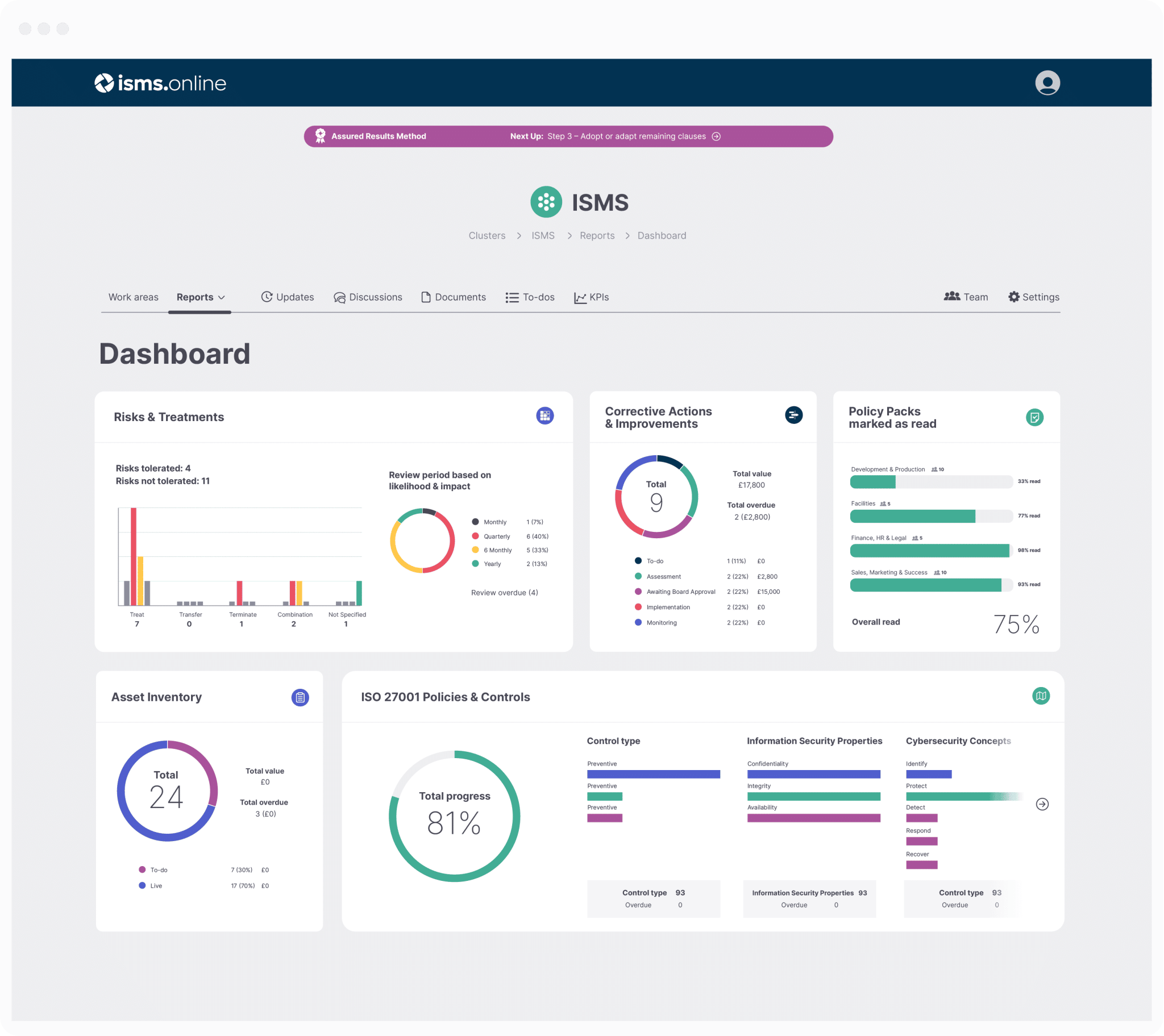

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Conducting a Gap Analysis for PCI DSS Compliance

Before embarking on the journey to PCI DSS compliance, it’s essential to understand where your organisation currently stands in relation to the standard’s requirements. This is where a gap analysis becomes an invaluable tool.

What is a Gap Analysis in the Context of PCI DSS?

A gap analysis is a methodical process used to compare your current security posture against the PCI DSS requirements. The primary goal is to identify “gaps” or areas where your current practices do not meet the standard’s criteria. This analysis forms the foundation for developing a roadmap towards full compliance.

The Importance of Conducting a Gap Analysis

Conducting a gap analysis is critical as it provides a clear picture of what needs to be addressed within your organisation to achieve compliance. Without this initial assessment, efforts to comply may be misdirected or inefficient, potentially leaving vulnerabilities unaddressed.

Identifying Gaps in Current Systems

Compliance officers can effectively identify gaps by systematically reviewing each of the PCI DSS requirements and comparing them against current security controls and processes. This involves examining documentation, interviewing relevant personnel, and performing technical assessments where necessary.

Focus Areas During the Gap Analysis

During the gap analysis, focus should be placed on areas such as data storage practices, encryption methods, access controls, and monitoring mechanisms. Special attention should also be given to any third-party service providers to ensure they too comply with PCI DSS requirements. A comprehensive review ensures that no aspect of the PCI DSS is overlooked, paving the way for a structured approach to achieving compliance.

At ISMS.online, we understand the complexities involved in navigating PCI DSS compliance. Our platform is designed to assist you in conducting thorough gap analyses, ensuring that you have a clear understanding of your compliance journey ahead.

Developing a Robust PCI DSS Compliance Plan

Creating a comprehensive PCI DSS compliance plan is a critical step for organisations handling cardholder data. This plan serves as a roadmap, guiding your organisation through the complexities of compliance and ensuring that all necessary security measures are in place.

Key Components of a Successful PCI DSS Compliance Plan

A successful PCI DSS compliance plan includes several key components:

- Scope Definition: Clearly defining the scope of your cardholder data environment (CDE) to ensure all relevant areas are included in the compliance efforts.

- Gap Analysis Results: Incorporating the findings from your gap analysis to address specific areas of non-compliance.

- Security Measures and Controls: Outlining the security measures and controls that will be implemented to meet the PCI DSS requirements.

- Roles and Responsibilities: Assigning roles and responsibilities to ensure accountability and effective implementation of the compliance plan.

- Timeline and Milestones: Establishing a realistic timeline with milestones for achieving compliance.

Tailoring the Compliance Plan to Your organisation’s Needs

It’s important to tailor your PCI DSS compliance plan to your organisation’s specific needs. This involves considering your organisation’s size, transaction volume, existing security infrastructure, and any unique challenges you may face. A customised plan ensures that the approach to compliance is both efficient and effective.

How ISMS.online Can Assist

At ISMS.online, we offer a comprehensive platform that can assist in developing and managing your PCI DSS compliance plan. Our platform provides:

- Pre-configured Templates: Access to pre-configured templates that can be customised to suit your organisation’s needs.

- Collaboration Tools: Tools that facilitate collaboration among your team members, ensuring that everyone is aligned and tasks are completed on schedule.

- Document Management: A centralised document management system for organising all compliance-related documentation.

Finding Templates and Examples

Organisations looking for templates or examples of effective PCI DSS compliance plans can find a wealth of resources on our platform. These templates serve as a starting point, helping you to structure your plan and ensure that all critical elements are included.

By following these guidelines and leveraging the resources available through ISMS.online, you can develop a robust PCI DSS compliance plan that not only meets the standard’s requirements but also strengthens your organisation’s overall security posture.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Implementing Security Controls and Measures

Ensuring PCI DSS compliance involves the implementation of both technical and administrative security controls. These controls are designed to protect cardholder data by maintaining a secure network, protecting stored data, and implementing strong access control measures, among other requirements.

Effective Security Controls for PCI DSS Compliance

The most effective security controls for achieving PCI DSS compliance include:

- Firewalls to protect the cardholder data environment from unauthorised access.

- Encryption of cardholder data transmitted across open, public networks.

- Antivirus software to protect against malware.

- Access control measures such as multi-factor authentication (MFA) to ensure that only authorised individuals have access to sensitive data.

The Importance of Technical and Administrative Controls

It is essential to implement both technical and administrative controls to achieve comprehensive security. Technical controls provide the physical and software-based security measures, while administrative controls involve policies, procedures, and operations that govern the conduct of personnel and the operation of the system.

Ensuring Long-Term Effectiveness of Security Controls

To ensure that security controls remain effective over time, organisations should:

- Conduct regular testing and monitoring of security systems.

- Perform risk assessments to identify and mitigate emerging threats.

- Update security policies and training programmes to address new vulnerabilities.

Overcoming Challenges in Implementing Security Controls

Common challenges in implementing PCI DSS security controls include:

- Resource constraints, which can be mitigated by prioritising controls that address the most critical vulnerabilities.

- Keeping up with evolving threats, which requires ongoing education and vigilance.

- Ensuring compliance across all systems, which can be achieved through comprehensive scoping and segmentation of the cardholder data environment.

At ISMS.online, we understand the complexities involved in implementing and maintaining PCI DSS security controls. Our platform offers tools and resources to help you develop, implement, and manage an effective security programme that meets PCI DSS requirements, ensuring the protection of cardholder data and maintaining trust with your customers.

Regular Monitoring and Testing of Security Systems

In the realm of PCI DSS compliance, the importance of regular monitoring and testing of security systems cannot be overstated. These practices are essential for identifying vulnerabilities, ensuring the effectiveness of security measures, and maintaining the integrity of cardholder data.

What Does Regular Monitoring Entail?

Regular monitoring involves the continuous observation of security systems and networks to detect any unauthorised access or anomalies that could indicate a security breach. This includes the review of logs, security alerts, and the performance of security systems to ensure they are functioning as intended.

The Necessary Role of Continuous Testing

Continuous testing of security systems is vital for maintaining PCI DSS compliance. It helps in identifying vulnerabilities that could be exploited by cybercriminals. Regular vulnerability scans, penetration testing, and security assessments are key components of an effective testing routine.

Setting Up Effective Monitoring and Testing Routines

To set up effective monitoring and testing routines, organisations should:

- Implement automated tools for continuous monitoring of security systems.

- Schedule regular vulnerability scans and penetration tests.

- Train staff to recognise and respond to security alerts promptly.

Tools and Services for Monitoring and Testing

Compliance officers can find a variety of tools and services designed to aid in the monitoring and testing of security systems. These range from automated monitoring software to specialised services that conduct penetration testing and vulnerability assessments. At ISMS.online, we offer resources and guidance to help you select and implement the right tools for your organisation’s needs, ensuring you maintain compliance with PCI DSS requirements.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Training and Educating Staff on PCI DSS Requirements

Ensuring your team is well-informed about PCI DSS requirements is not just a regulatory necessity; it’s a critical component of your organisation’s security posture. Comprehensive training programmes are essential for equipping your staff with the knowledge they need to protect cardholder data effectively.

What Should a Comprehensive PCI DSS Training programme Include?

A thorough PCI DSS training programme should cover:

- Overview of PCI DSS: Introduction to the standards and their importance.

- The 12 PCI DSS Requirements: Detailed explanation of each requirement.

- Common Security Threats: Information on potential security threats and how to prevent them.

- Best practices for Data Protection: Guidance on protecting cardholder data.

- Response Procedures: Training on how to respond to a data breach.

The Critical Role of Staff Education

Educating your staff on PCI DSS requirements is necessary for several reasons:

- Risk Mitigation: Well-informed employees are less likely to inadvertently cause data breaches.

- Regulatory Compliance: Ensures your organisation meets PCI DSS educational requirements.

- Cultural Shift: Fosters a culture of security within the organisation.

Developing Engaging and Informative Training programmes

To develop engaging training programmes, consider:

- Interactive Learning: Incorporate quizzes and interactive modules.

- Real-World Examples: Use case studies to illustrate the importance of compliance.

- Regular Updates: Keep the training material up-to-date with the latest PCI DSS standards.

Resources and Tools from ISMS.online

At ISMS.online, we provide a suite of resources and tools designed to support your PCI DSS training efforts, including:

- Customisable Training Templates: Tailor our templates to fit your organisation’s specific needs.

- Comprehensive Documentation: Utilise our documentation to support your training programmes.

By leveraging these resources, you can ensure your staff is well-prepared to protect cardholder data and maintain PCI DSS compliance.

Further Reading

Managing Vendors and Third-Party Service Providers

In the context of PCI DSS compliance, managing vendors and third-party service providers is a critical aspect that organisations must navigate carefully. These entities often handle or have access to cardholder data, making their compliance with PCI DSS standards as essential as your own.

Requirements for Managing Vendors

PCI DSS requires that all third-party service providers who handle, process, or have access to cardholder data must adhere to the same security standards as the organisations that hire them. This includes implementing robust security measures, undergoing regular audits, and maintaining compliance documentation.

The Importance of Third-Party Compliance

Ensuring that third-party service providers are compliant is vital for several reasons:

- Data Security: Non-compliant vendors can introduce vulnerabilities into your cardholder data environment (CDE), increasing the risk of data breaches.

- Regulatory Obligations: organisations are ultimately responsible for their own PCI DSS compliance, including the compliance of their vendors.

- Reputational Risk: A data breach caused by a third-party can damage your organisation’s reputation and erode customer trust.

Monitoring and Managing Vendor Compliance

To effectively monitor and manage vendors’ compliance, organisations should:

- Conduct Due Diligence: Evaluate potential vendors’ security practices and PCI DSS compliance status before engaging their services.

- Establish Clear Contracts: Include specific compliance requirements and responsibilities in contracts with vendors.

- Regular Assessments: Periodically review vendors’ compliance status through audits or compliance reports.

Addressing Challenges in Vendor Management

Challenges in vendor management typically arise from:

- Lack of Transparency: Some vendors may not readily provide evidence of their compliance status.

- Complex Supply Chains: Managing compliance across multiple vendors can become complex.

To address these challenges, organisations can:

- Leverage Technology: Use compliance management platforms like ISMS.online to streamline vendor assessments and documentation.

- Build Strong Relationships: Foster open communication with vendors to encourage transparency and cooperation.

By taking a proactive and structured approach to vendor management, organisations can ensure that their third-party service providers uphold the necessary PCI DSS standards, thereby protecting cardholder data and maintaining compliance.

Preparing for and Conducting PCI DSS Audits

Preparing for a PCI DSS audit is a critical step in validating your organisation’s compliance with the Payment Card Industry Data Security Standard. This process involves a thorough review of your security policies, procedures, and technical controls to ensure they meet the stringent requirements set forth by the PCI DSS.

Understanding the Audit Process

A PCI DSS audit is conducted by a Qualified Security Assessor (QSA) or an Internal Security Assessor (ISA) who evaluates your organisation’s adherence to the PCI DSS requirements. The audit process includes a review of your documented security policies, an examination of your technical controls, and interviews with key personnel.

The Importance of Audits

Audits are required for several reasons:

- Validation of Compliance: They provide an official assessment of your compliance status.

- Identification of Gaps: Audits help identify any gaps in your security controls or policies.

- Guidance for Improvement: They offer recommendations for enhancing your security posture.

Ensuring a Smooth Audit Process

To ensure a smooth and successful audit process, organisations should:

- Conduct a Pre-Audit Assessment: Identify and address any potential compliance gaps before the official audit.

- organise Documentation: Have all necessary documentation organised and readily available for the auditor.

- Engage with Stakeholders: Ensure that all relevant stakeholders are informed and prepared for the audit process.

Finding Guidance for the Audit Process

Compliance officers can find guidance on navigating the audit process from several sources:

- PCI Security Standards Council (PCI SSC): Offers comprehensive guidelines and resources.

- Qualified Security Assessors (QSAs): Provide pre-audit consultation services.

- ISMS.online: Our platform offers tools and resources to help you prepare for your PCI DSS audit, including templates for documenting security policies and procedures, and guidance on organising your compliance evidence.

By thoroughly preparing for your PCI DSS audit and utilising available resources, you can ensure that your organisation is well-positioned to demonstrate compliance and maintain the trust of your customers and partners.

Addressing Non-Compliance and Remediation Strategies

Identifying areas of non-compliance with PCI DSS can be a daunting realisation for any organisation. However, recognising these gaps is the first step towards strengthening your security posture and protecting cardholder data more effectively.

Steps to Take After Identifying Non-Compliance

Upon identifying non-compliance with PCI DSS, immediate action is required. The initial steps should include:

- Detailed Assessment: Conduct a thorough analysis to understand the extent and specifics of the non-compliance.

- prioritisation: Identify which issues pose the greatest risk and prioritise remediation efforts accordingly.

- Remediation Plan Development: Develop a detailed remediation plan that outlines the steps needed to achieve compliance.

The Importance of Immediate Action

Immediate action is mandatory for several reasons:

- Minimising Risk: The longer non-compliance issues persist, the greater the risk of a data breach.

- Regulatory Compliance: Prompt action demonstrates to regulators and partners your commitment to security and compliance.

- Trust Preservation: Taking swift action helps maintain the trust of your customers and stakeholders.

Developing Effective Remediation Strategies

Effective remediation strategies should be comprehensive and tailored to the specific issues identified. This includes:

- Implementing Technical Fixes: Addressing the technical aspects of non-compliance, such as updating software or enhancing encryption methods.

- Policy and Procedure Updates: Revising policies and procedures to prevent future instances of non-compliance.

- Staff Training: Ensuring staff are trained on new policies and compliance requirements.

How ISMS.online Can Assist

At ISMS.online, we understand the challenges organisations face in addressing non-compliance. Our platform offers:

- Remediation Tracking: Tools to help you track the progress of your remediation efforts.

- Documentation Management: A centralised location for all compliance-related documentation, making it easier to manage and update policies and procedures.

- Collaboration Features: Facilitates collaboration among team members working on remediation tasks, ensuring everyone is aligned and informed.

By taking a structured approach to addressing non-compliance and leveraging the tools and resources available through ISMS.online, organisations can effectively navigate the remediation process and strengthen their compliance posture.

Keeping Up with PCI DSS Updates and Changes

In the ever-evolving landscape of cybersecurity, staying abreast of the latest PCI DSS standards is not just a regulatory requirement; it’s a critical component of your organisation’s security posture. The Payment Card Industry Data Security Standard (PCI DSS) is regularly updated to address new threats and vulnerabilities, making it essential for organisations to remain proactive in adapting to these changes.

The Importance of Staying Updated

The primary importance of staying updated with PCI DSS standards lies in the protection it offers. As cyber threats evolve, so too do the defences required to protect cardholder data. Adhering to the latest standards ensures that your organisation employs the most current and effective security measures.

Proactive Adaptation to New Requirements

Being proactive in adapting to new PCI DSS requirements is crucial for maintaining compliance and safeguarding against data breaches. This proactive stance involves regularly reviewing the PCI DSS documentation for updates, assessing the impact of these changes on your current security measures, and implementing necessary adjustments in a timely manner.

Ensuring Awareness of Updates and Changes

For compliance officers, ensuring awareness of updates and changes to the PCI DSS can be achieved through:

- Regular Consultation: Regularly consulting the official PCI Security Standards Council (PCI SSC) website for announcements and updates.

- Subscription Services: Subscribing to newsletters or alert services that provide updates on PCI DSS changes.

- Professional Networks: Engaging with professional networks or forums where updates and best practices are discussed.

Reliable Sources of Information

Reliable sources of information on PCI DSS updates include:

- PCI Security Standards Council (PCI SSC): The official source for all PCI DSS standards and documentation.

- ISMS.online: Our platform provides resources and guidance to help you navigate the complexities of PCI DSS compliance, including updates and changes to the standards.

By staying informed and proactive, you can ensure that your organisation not only remains compliant with PCI DSS but also maintains a robust defence against the ever-changing landscape of cyber threats.

We Offer Expert PCI DSS Implementation Support

Navigating the complexities of PCI DSS compliance can be a challenging endeavour for any organisation. At ISMS.online, we are dedicated to simplifying this process for you, providing comprehensive support and tools designed to streamline your journey towards compliance.

How ISMS.online Can Assist Your Organisation

Our platform offers a suite of features tailored to assist with every aspect of PCI DSS compliance. From initial gap analysis to ongoing compliance management, we provide:

- Guided Compliance Process: Step-by-step guidance through the PCI DSS compliance process, ensuring you understand and meet each requirement.

- Dynamic Risk Management Tools: Advanced tools designed to identify and manage PCI DSS threats, enhancing your decision-making process.

Services and Tools Offered by ISMS.online

We understand that each organisation’s needs are unique. That’s why our platform offers:

- Collaboration Tools: Facilitate effective collaboration among your team members, ensuring everyone is aligned and tasks are completed efficiently.

- Comprehensive Documentation Management: A centralised system for managing all your compliance-related documentation, making it easier to maintain and update your compliance status.

Why Choose ISMS.online for Your PCI DSS Compliance Needs?

Choosing ISMS.online means opting for a partner that understands the intricacies of PCI DSS compliance. Our platform is designed to:- Simplify the Compliance Process: Make the journey towards compliance as smooth and straightforward as possible.

- Provide Expert Support: Offer access to a team of experts who can guide you through every step of the compliance process.

- Ensure Comprehensive Compliance Management: Equip you with the tools and resources needed to achieve and maintain compliance effectively.

At ISMS.online, we are committed to helping you achieve and maintain PCI DSS compliance, ensuring your organisation's security and compliance posture is robust and reliable.