Are Non-EU Companies Really “Out” of NIS 2-and What’s the True Compliance Trigger?

The line between being “in” or “out” of NIS 2 isn’t as obvious as a company headquarters or a VAT registration. If your SaaS, cloud service, or managed tech lands in front of EU customers, regulators see you as part of the operational mesh-especially if your business sustains or enables Europe’s digital, critical, or connected infrastructure.

Global compliance isn’t decided by your postcode; it’s defined by the reach of your technology and the evidence trail you leave behind.

You might assume that absence of a physical office lets you sidestep European regulatory risk, but this assumption often fails under regulatory scrutiny-or the scrutiny of procurement, audit, and third parties who carry board liability for every firm in their value chain. The focus is shifting: What matters is not where you sit, but whom you serve, how, and what demonstrable steps you’ve taken to proof your business against EU-specific cyber and operational threats.

Why Physical Borders Dont Keep Out NIS 2

With NIS 2 extending its reach to service providers, infrastructure enablers, and indirectly to their supply chains, your exposure multiplies with every new deal, sector expansion, or feature release that makes your platform relevant in the EU context. Regulators and buyers pursue the practical evidence of EU targeting: local language support, EU-law references in contracts, euro billing, or GDPR integration in your product-all these flag commercial intent.

What triggers the in-scope test?

- Sales and support in EU locales: or languages, or contract mentions of EU law

- EU-based critical customers: , not just retail but in health, finance, utilities, and infrastructure

- Direct or indirect supply to regulated sectors: , or onboarding of subsidiaries that further serve EU clients

- Reference to EU law in privacy, incident, or contractual documents:

This digital footprint, rather than a postal address, is what draws you squarely into NIS 2s field of view. Your board must understand that legal exposure grows as fast as the evidence (or gap) you leave-making your next risk audit, procurement negotiation, or customer onboarding a potential compliance event.

Book a demoHow Your Company’s Digital and Commercial Footprint Decides NIS 2 Exposure

Even well-informed teams underestimate how many internal and external touchpoints can trigger a “yes” for NIS 2 scope. Regulatory reviews and procurement audits increasingly hinge on detailed scrutiny of your service channels, sales, onboarding flows, and support provisions. Risk is dynamic: a single new customer in a critical or “important” EU sector can bring all related entities under the Directive in a single quarter.

Key Triggers Beyond the Obvious

1. Product and Website Localization

If your digital front end-website, app, support site-offers EU language localization, euro payment options, or references EU legal baselines, you’re signalling presence in the market.

2. Sector and Supply Chain Dependencies

Tech vendors that supply providers in health, financial services, utilities, or digital infrastructure (even as subcontractors or component providers) inherit their customers’ regulatory burdens. NIS 2 scopes obligations from top to bottom.

3. Sales and Business Development

Just one contract, RFP, or ongoing supply chain slot tied to a regulated EU entity can trigger an “in-scope” classification-even without a subsidiary or regional office.

4. Support, Data, and Incident Response

If your post-sales support, customer service teams, documentation, or incident playbooks specifically address EU regulations, time zones, or languages, you are operationally present.

The business world rewards precision-track every EU-facing activity as a compliance asset, not just a potential liability.

The Living Audit Principle

The EU’s enforcement language is clear: regulators and procurement leads look not just at point-in-time activities but at your living map of digital and legal connections. Regular self-audits and quarterly exposure mapping aren’t optional-they’re competitive differentiators, mitigating the “out this year, in next” risk every time your sales, product, or partnership teams evolve.

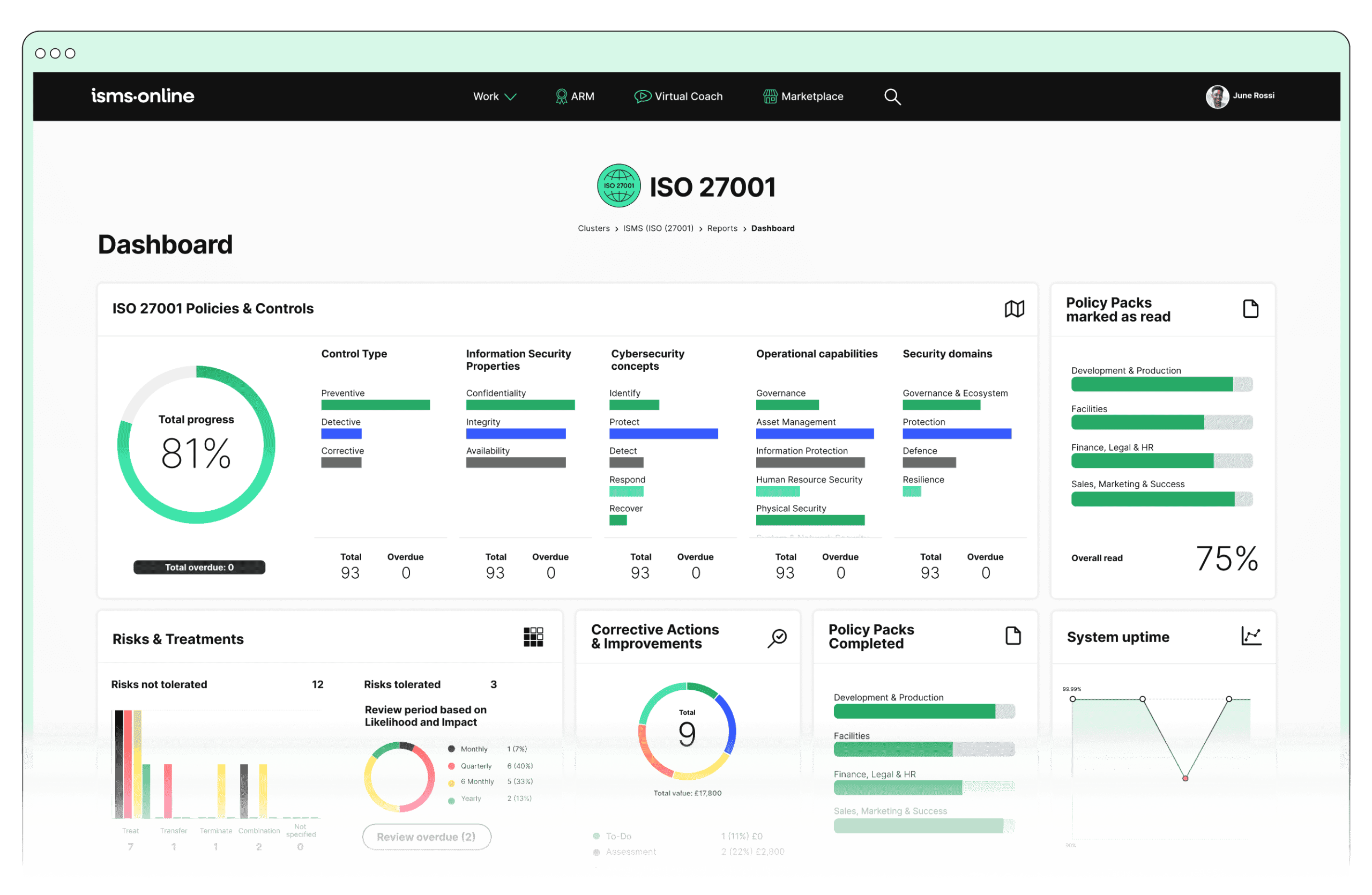

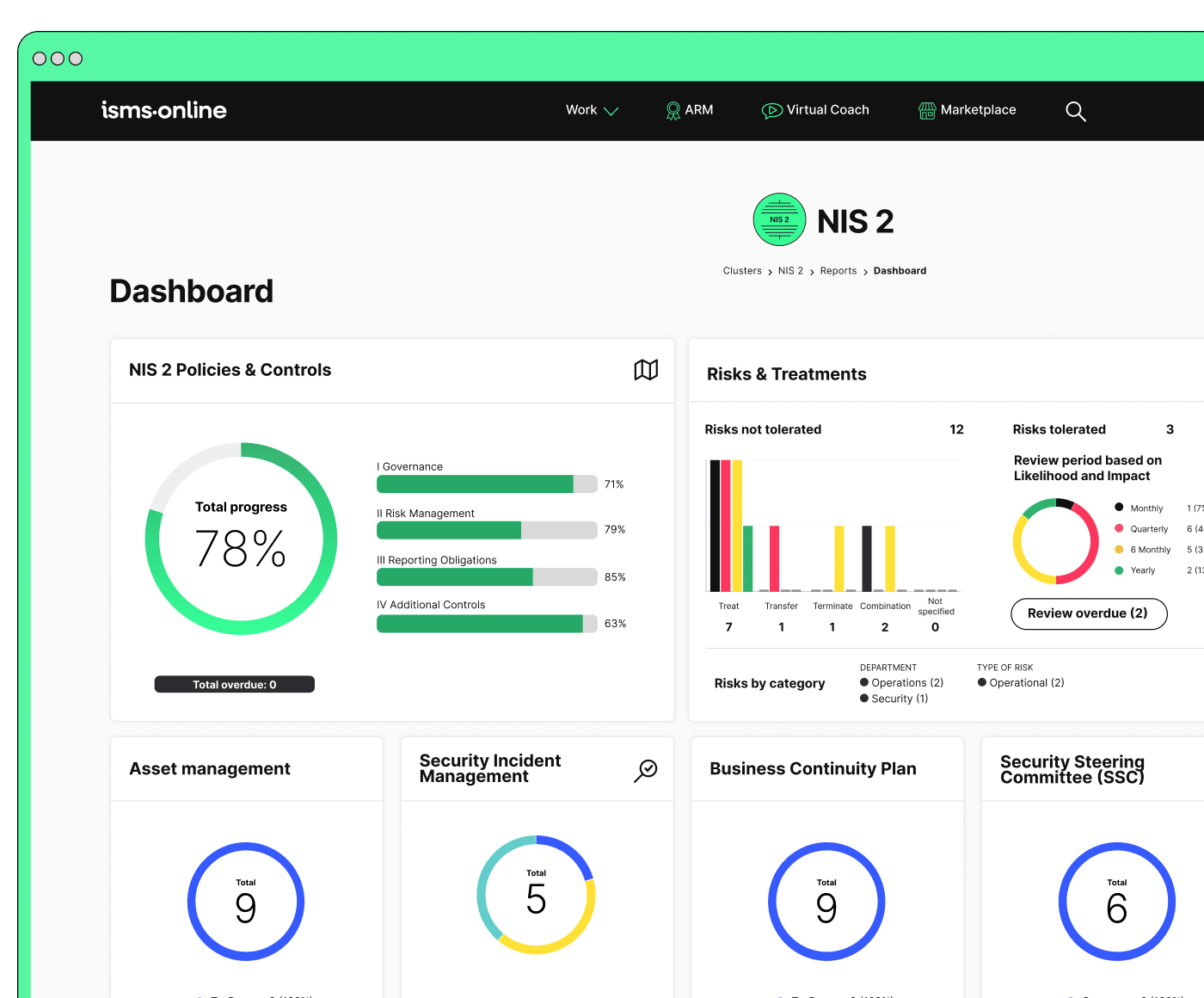

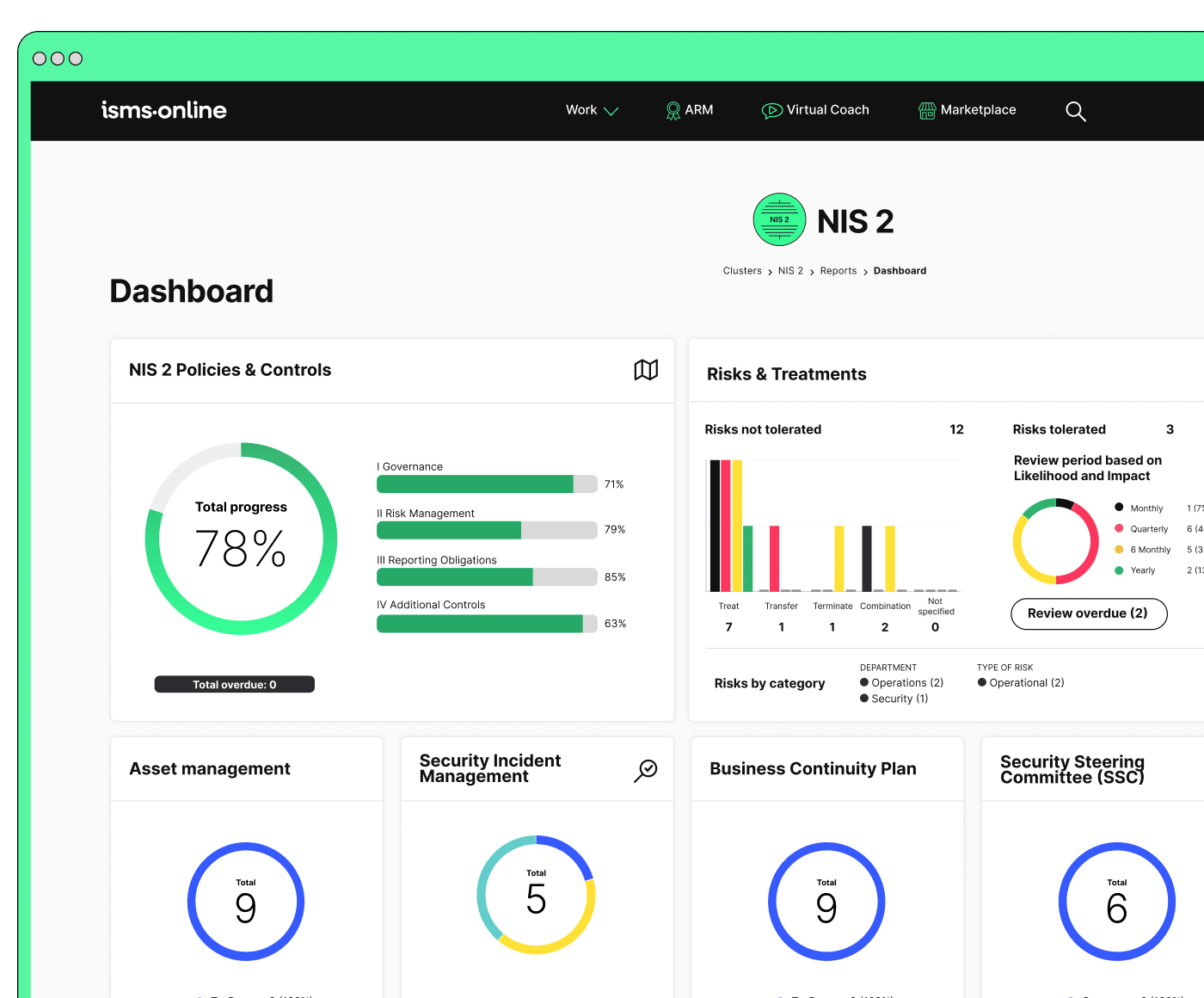

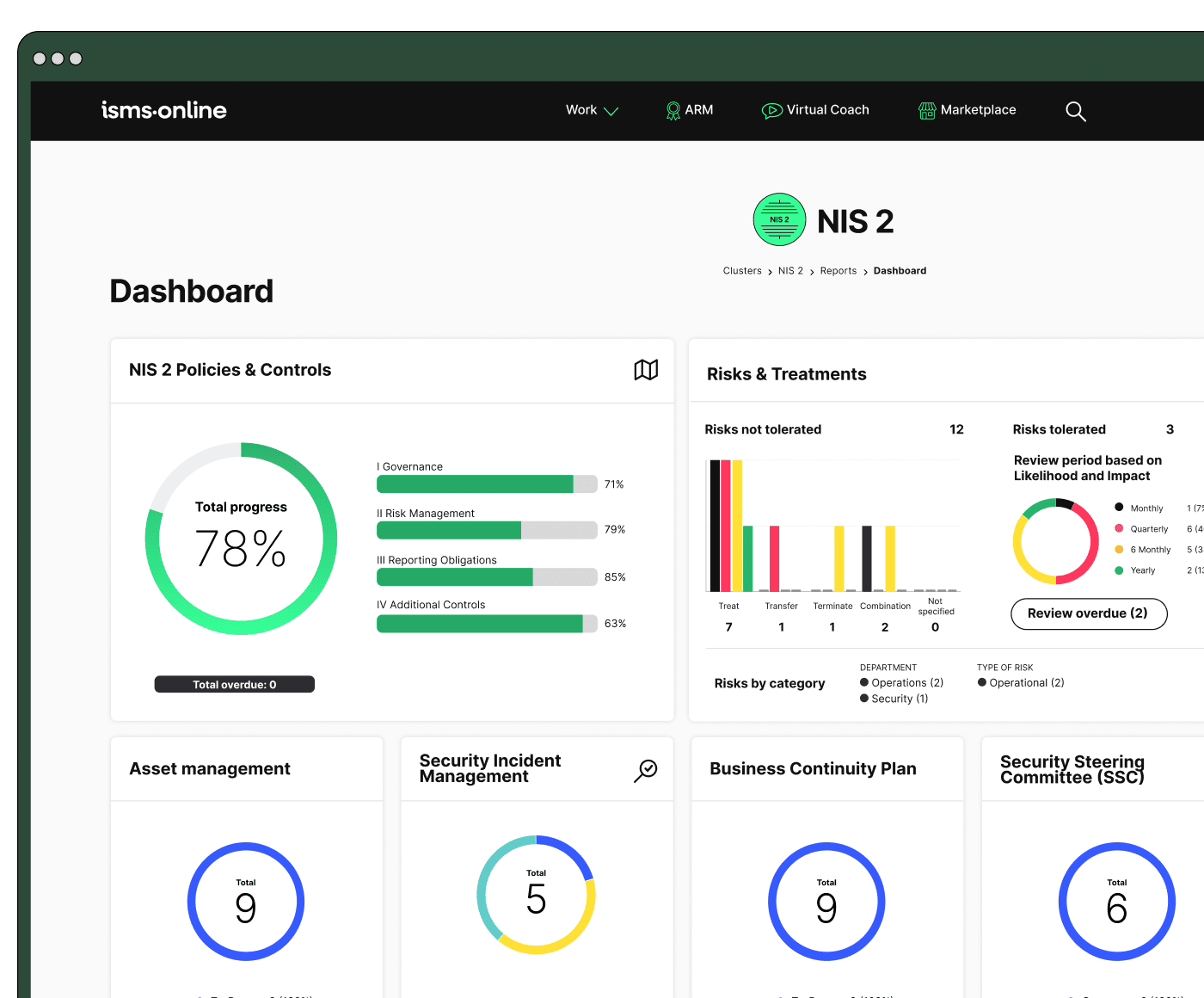

Master NIS 2 without spreadsheet chaos

Centralise risk, incidents, suppliers, and evidence in one clean platform.

How “Targeting” the EU-Not Just “Establishment”-Pulls You In

NIS 2 enforcement depends on how you serve, not just where you’re headquartered. The Directive’s expansion to “offering services” brings software, platform, and service providers of any size into scope at the exact moment they orient to EU needs, compliance, or regulations.

Operational Red Flags and Compliance Indicators

- Customer Agreements Specify EU Data or Law: Even without an EU legal entity, mentioning GDPR or EU contract terms in your agreements triggers accountability.

- Localization in Onboarding and Support: Providing help desks, knowledge bases, or onboarding flows tailored to European time zones, languages, or sector requirements expands your operational presence.

- Subsidiaries, White-label, or Affiliate Activity: Non-EU parents or group companies may be in scope when one entity within the group targets or serves EU users.

- Compliance Rationale and Audit Logs: Regulators and auditors now expect boards to document who makes NIS 2 applicability calls, under what methodology, and when those conclusions are re-examined-a living rationale, not a static memo.

Quarterly audit: Maintain a real-time ledger of sales, support, data storage, and operational touchpoints that link to the EU. Each entry is evidence to show either appropriate compliance margins-or (if not maintained) a credibility risk in audits or buyer negotiations.

What Changes The Calculation

- New sector engagement (critical, important, or regulated industries)

- Participating in EU RFPs or onboarding programmes

- Shifts in corporate structure involving European subsidiaries, partners, or supply

- Revising contracts or support to cover EU regulation, incident response timelines, or cross-border data

Your exposure is never static. Every new customer, product launch, or procurement requirement can pull you over the threshold if not strategically tracked and operationalised.

Why Procurement Demands and Supply Chains Create NIS 2 Compliance Before Regulators Knock

The most dramatic NIS 2 compliance pressure doesn’t come from a government regulator-it comes from EU procurement pipelines and supply chain partners facing their own deadlines and liability. Lost deals, stalling contracts, and blocked supplier status now lead the queue of signals that NIS 2 is a present-tense business concern.

How Upstream Pressure Works in Practise

- Procurement Questionnaires as Compliance Gatekeepers: EU entities-especially in energy, health, finance, digital, and public services-use NIS 2-aligned compliance forms as the first hurdle in new supplier onboarding.

- RFP Mandates: Requests for proof of active, logged compliance go beyond simple policy statements. Without dynamic mapping of NIS 2 controls, vendors are increasingly barred from shortlists.

- Simultaneous Frameworks: EU buyers are now mapping NIS 2 and GDPR (or DORA) onto global supply chains. If your control and evidence stack isn’t mapped for both, you’re at higher risk of RFP loss or de-prioritisation.

- Cost of Remediation: Delaying compliance comes with measurable penalties-remediation after a procurement halt or sales loss is always costlier than early action.

| Compliance Pressure Point | Business Impact |

|---|---|

| Upstream procurement checklists | Early deal loss, pipeline stall |

| RFP, due diligence delays | Lost trust, slower sales cycles |

| Non-mapped controls | Off-listing for critical bids |

| Absence of evidence | Audit failures, partnership blocks |

Today’s buyers hold the compliance keys-make readiness your revenue engine, not a regulatory afterthought.

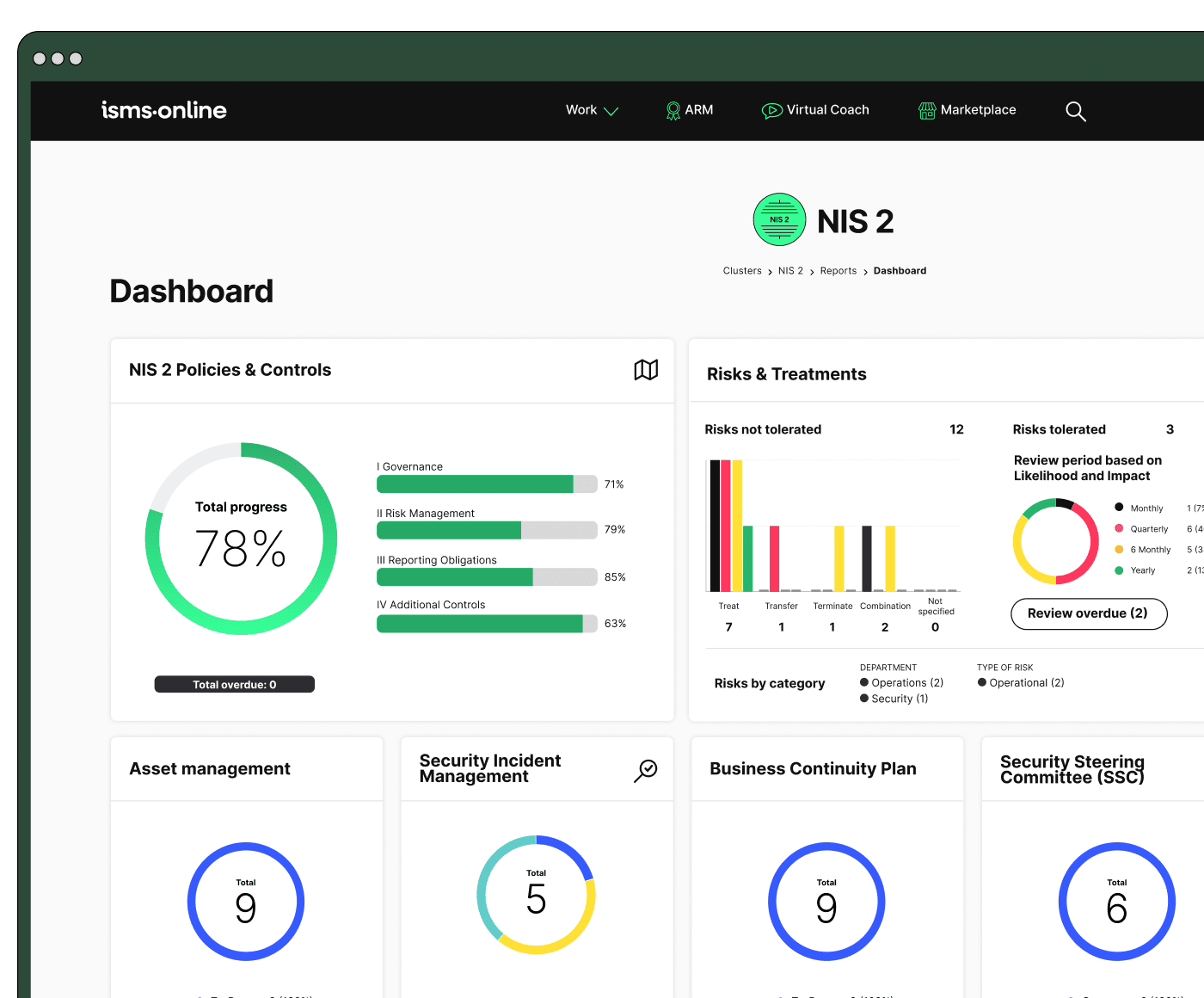

Be NIS 2-ready from day one

Launch with a proven workspace and templates – just tailor, assign, and go.

Key “Go/No-Go” Triggers: The Bright-Lines That Put You In Scope

While nuance exists around interpretation, NIS 2 codifies clear “bright-line” triggers-exceeding these pulls a company or group “in scope” for obligations.

| Triggering Threshold | Example Mechanism | What to Log |

|---|---|---|

| >50 EU-facing staff (FTEs) | Payroll, support, outsourced roles | Quarterly HR/commercial roll-up |

| ≥€10M EU turnover | Contract ledger, revenue reports | Geographic/sector revenue audit |

| Essential/Important sector | Mapping to NIS 2 annex categories | Sector review, customer type onboarding |

| Direct EU service provision | Sales, cloud support, localised services | Customer log, support ticket analytics |

| Board-level auditability | Quarterly compliance review | Board minutes, rationale logs, ongoing re-review |

These triggers are amplified in regulated sector deals, complex group structures, and where critical digital supply is involved. The risk of incorrect “out of scope” assessment escalates with each additional layer of indirect business connection into the EU.

Automation tips:

- Programmatic onboarding NIS 2 flags into sales and HR systems

- Build compliance registers with real-time flags for threshold boundaries

Ignore at your own risk: Each deal, project, or contract revision provides another touchpoint where your actual exposure can be made visible in internal or buyer audits.

Practical Playbook: How Non-EU Providers Can Build, Anchor, and Prove Resilience

Facing the reality of NIS 2 triggers, proactive businesses create a continuous “resilience loop” for compliance-not just to limit penalty, but to remain credible to buyers, regulators, and capital markets.

Anchoring Resilience Before You’re Audited

Appoint and Register a NIS 2 Representative

Secure a named board-level rep (distinct from a DPO); log this at the board and, if required, register with country authorities.

Upgrade Documentation to a Living, Auditable State

Systems should move beyond static PDFs to version-controlled evidence banks. Each control, incident, and policy must be logged with time, status, and role-based approval (ISO 27001 A.5.35, NIS 2 Art. 24).

Quarterly Living Audit and Risk Mapping

Run regular mapping traces of every EU-facing deal, customer, and support channel. Use these audits to update strategies and maintain compliance momentum.

Incident Notification Playbooks

Implement tested, multilingual notification templates and require drills. Missed 24/72-hour reporting is a failure flag for buyers and authorities.

| Compliance Step | Proof Mechanism |

|---|---|

| Board-approved NIS 2 rep | Board minutes, registry logs |

| Dynamic evidence logs | Versioning, approval, mapping tables |

| Quarterly reviews | Board/management review, incident drills |

| Notification readiness | Drills, template logs, test events |

All your NIS 2, all in one place

From Articles 20–23 to audit plans – run and prove compliance, end-to-end.

Providing Living, Mapped Evidence: What Buyers and Auditors Now Demand

With NIS 2, the regulatory and procurement expectation is living, mapped, and time-stamped evidence-no more “document dump” audits.

What Modern Evidence Looks Like

- Control versioning: Each update contains author, date, and traceability to mapped standards (ISO 27001, NIS 2, GDPR, DORA).

- Incident logs: Permissioned, time-stamped, with drill/test event overlays for audit defence.

- Procurement dashboards: Buyers expect modular, permissionable artefact bundles showing up-to-date readiness.

- Audit traceability: Each risk, control, and policy log cross-references back to the SoA, plus which customer or incident brought the control to life.

| Expectation | Operationalisation | ISO 27001/Annex A |

|---|---|---|

| Bilingual incident plans | Living, tested template | A.5.27, A.5.26 |

| Board sign-offs | Quarterly approval logged | 5.3, A.5.4, A.5.15 |

| Supplier reviews | 3rd-party mapped, logged | A.5.19 / Art. 21 |

| Dynamic audits | Permissioned dashboards | A.5.35 / Art. 25 |

A mapped traceability approach-where every customer, contract, or event triggers evidence threading-is the heart of modern, trusted compliance.

Penalties, Revenue Loss, and the Hidden Cost of “Out-of-Scope” Assumptions

Organisations assuming they’re “out” until proven otherwise risk financial and reputational shock-through lost deals, regulator investigations, and director-level accountability.

| Offence | Penalty | Role Impacted |

|---|---|---|

| Unregistered status | Up to €10M fine | Board, Compliance |

| Missed notification window | Lost deals | CISO, Operations |

| Repeated or “reckless” failures | Director liability | CEO, Board |

| Procurement rejection | Revenue loss | Sales, Commercial |

Recent year data shows that 50% of EU buyers now pause deals at the compliance check stage when mapped evidence is lacking-a trend gaining pace as digital supply chains mature and board awareness of NIS 2 risk grows.

Only Real-Time Evidence Wins

Procurement won’t accept static documents or after-the-fact assertions. They want real-time, linked, and signed logs that echo exactly the NIS 2/ISO 27001 (or DORA/GDPR) clause or buyer requirement under review.

Resilience Means Real-Time Monitoring, Automation, and Board-Level Engagement

Compliance is no longer episodic fighting-but an always-on operating system. Board-level accountability is a daily, logged practise-not an annual event.

Building an “Always-On” Compliance Fabric

- Automate NIS 2 and ISO 27001 logging, threshold checks, and audit event triggers.

- Run quarterly drills, incident replays, and audit logs that trace every material service, customer, or control change.

- Elevate every compliance decision, risk update, and incident log for board or management review-with versioned minutes and rationale.

- Build dashboards and procurement evidence bundles for every new EU-facing sales cycle.

| Trigger Event | Risk Update | Linked Control/SoA | Evidence Example |

|---|---|---|---|

| New EU client onboarded | Financial risk | A.5.19, NIS 2 Art.21 | Signed scope file, contact logs |

| Major incident drill | Operational risk | A.5.26, NIS 2 Art.23/24 | Drill log, chat logs |

| Board compliance review | Strategic risk | A.5.31, NIS 2 Art.25 | Board minutes, update record |

| Cross-framework change | Procedural risk | Annex A.8, SoA map | Mapping doc, change log |

The modern compliance leader doesn’t just prevent penalty-they build a foundation for revenue, resilience, and trust.

With ISMS.online, Turn NIS 2 Compliance Into Your Competitive Edge

Your compliance stack has to be living, mapped, and always ready. ISMS.online automates your NIS 2/ISO 27001/GDPR evidence, consolidates mapped controls, logs every change, and prepares procurement bundles on demand.

With every policy, risk, and security event permission-audited and version tracked, your teams are never caught unprepared-whether onboarding a new EU customer, responding to procurement, or passing a regulatory review.

Why gamble with lagging, manual, or unlinked controls? With ISMS.online, every obligation is mapped in real time, every control gap surfaces before a deal is lost, and compliance moves from a cost to the foundation of trust and resilience leadership.

The bar is rising-proof, not promise, now determines your access to the world’s highest-value digital markets. Modern businesses prepare their proof before they are asked for it.

Don’t let NIS 2 stall your next deal, audit, or funding round-make it your edge, with ISMS.online’s always-on trust fabric.

Frequently Asked Questions

When must non-EU companies comply with NIS 2 when serving EU customers?

Non-EU companies must comply with NIS 2 whenever their services-whether SaaS, cloud, managed services, digital infrastructure, or IT platforms-are available to, or specifically target, users or organisations in the European Union. Headquarters location is irrelevant: if your platform, product, or support reaches EU clients-directly or through a partner, subsidiary, or distributor-NIS 2 can apply (EU Commission, 2023). The litmus test is “offering services to the Union” (Art. 26): even absent a local office, compliance triggers if your service can be purchased, contracted, or depended upon for essential digital or operational functions within any EU country.

Any business that makes its service accessible to the EU-by language, payment, support, or distribution-should assume it is in the NIS 2 regulatory scope irrespective of its base jurisdiction.

How does your global business model or tech stack create NIS 2 obligations without an EU entity?

Two fundamental triggers are most relevant: (1) technical or commercial accessibility in the EU, and (2) demonstrable EU-facing engagement or support. Key indicators include euro billing, translated websites, EU privacy/legal mentions, employees or contractors located in Europe, or contracts with sector-critical EU clients (per NIS 2 Annexes, e.g., energy, finance, cloud, health, digital infrastructure). Both direct (local branches, EU sales) and indirect models (resellers, embedded integrations, channel partners) can pull you in (ENISA, 2024). Even a “one-off” contract with an EU regulated business, or onboarding an EU-based customer into your SaaS, may activate full NIS 2 compliance demands.

What documentation, contracts, or practises expose a non-EU firm to NIS 2 enforcement?

Any service agreement, onboarding material, support SLA, or T&Cs referencing EU laws, providing EU-based support, or explicitly addressing EU customer requirements signals NIS 2 relevance. Authorities investigate beyond corporate registration-if a material portion of your operations, support, leadership, or sales occur in Europe, or you document a “main establishment” (by workforce or business function), European enforcement can reach you (Orrick, 2024). Localization triggers-such as euro pricing, multilingual portals, or regionalized contracts-have already led to regulatory scrutiny. Additionally, affiliate group structures matter: if a group company, partner, or platform is within scope, your obligations may cascade.

How are EU buyers, procurement teams, and sales pipelines enforcing NIS 2 on global vendors?

Procurement cycles in regulated EU sectors now routinely demand mapped, digital “proof packs” aligned to NIS 2-even from US, UK, or APAC SaaS and tech vendors that already hold ISO 27001 or SOC 2. RFPs increasingly make NIS 2 a non-negotiable requirement, and deal cycles stall or die if documented compliance isn’t available early (PwC, 2024, Thomson Reuters, 2024). Proactive vendors pre-empt buyer pushback by integrating NIS 2 documentation into onboarding-combining buyer trust and faster revenue realisation.

What minimum actions must non-EU companies take to meet NIS 2 expectations?

- Appoint an EU-based NIS 2 representative: This must be separate from your GDPR representative; it must be board-sanctioned and vested with real authority (GDPR Info, Art. 27).

- Register in each relevant sector and EU country: Registration is not blanket-each sector/state must be registered individually.

- Build a digital, versioned compliance evidence stack: EU auditors require a live, version-controlled evidence management system-not just static files or PDFs (Law.com, 2024).

- Test and document incident response and supply chain readiness: Simulate (and log) incidents to meet tight 24/72-hour reporting deadlines; multilingual and cross-team tabletop exercises are now expected (BSI, 2024).

- Update contracts, onboarding, and procurement playbooks with NIS 2 mappings: Replace generic “ISMS” references with explicit NIS 2 obligations-sector, country, and board accountability requirements.

True EU market access starts with digital proof and live-tested response. Compliance is recurrent-never just checkboxed.

What documentation gaps-or evidence beyond ISO 27001-do EU buyers and auditors require?

ISO 27001 typically covers 70–80% of NIS 2’s expectations, but the balance-incident notification, supply chain registers, ongoing remediation logs, and board-level oversight-is unique to NIS 2 (Linklaters, 2024; Deloitte, 2024). Auditors expect digitally mapped, dynamic “proof packs” aligned to NIS 2 obligations, including sector onboarding, versioned risk logs, policy acknowledgements, and supply chain compliance registers. Buyers are increasingly requesting these at the RFP or negotiation table-well before final agreement.

What legal, financial, or board-level risks do non-EU companies face under NIS 2?

Regulatory fines reach €10 million or 2% of global turnover; commercial buyers are excluding vendors who cannot produce mapped, live compliance evidence, Bain, 2024). Board-level risk ownership, clear authority trails, and documented, rapid remediation are legal minimums. Fragmented or outdated evidence not only leads to legal exposure but can block contracts or erode hard-won EU trust (Freshfields, 2024). Elevate quarterly self-checks and remediation logs for demonstrable trust and readiness.

ISO 27001/NIS 2 Audit Bridge

| Expectation | Operationalisation | ISO 27001 / Annex A |

|---|---|---|

| Board-level risk ownership | Documented approval, board minutes | 5.2, 9.3, A5.4, A8.34 |

| Supply chain traceability | Supplier registers, risk reviews | 6.1, 8.1, 8.2, A5.19–A5.22 |

| Live incident notification (24/72h) | Doc’d plans, reporting logs | A5.24–28, A8.15–17 |

| Version-controlled digital proof | Tracked, versioned evidence | 7.5.3, 10.1, A5.31, A5.35 |

| Sector-specific onboarding | Mapped packs, country coverage | A5.7, A5.20, A8.8 |

Compliance Traceability Snapshots

| Trigger | Risk Update | Control/SoA | Evidence Logged |

|---|---|---|---|

| New EU client onboarded | Regulatory review | A5.19, A6.1, 8.1 | Board minute, supplier list |

| Website gets translated | Scope re-evaluated | 4.2, 6.1.2, 7.5 | Localization checklist |

| New supplier added | Vendor risk update | A5.20, A5.21 | Updated contracts, log |

| Incident: breach call | Escalation to board | A5.24, A5.26, A8.15 | Incident response docs |

| New sector client entered | Sector onboarding | A5.7, A5.20 | Segment onboarding pack |

Ready to secure your EU market opportunity with audit-ready, digital trust?

When mapped compliance evidence is just a click away, your team avoids risk, shortens procurement cycles, and keeps EU clients loyal. Request a digital NIS 2 readiness review with ISMS.online and show buyers, boards, and auditors you’re ahead of the curve-before they ever ask.