Why ISO 27001 Compliance Software is Critical for the Payments Industry

Payments teams chase uptime and auth rates while regulators, schemes, and banking partners tighten scrutiny. Platform/vendor sprawl scatters proofs of control exactly when a PCI ROC/SAQ, acquirer onboarding, or scheme investigation lands. Third-party dependencies (acquirers, KYC/KYB, open banking, cloud) widen the blast radius if ownership is unclear. Audit sprints drain capacity and leave brittle systems that crack under the next questionnaire.

- Platform & vendor sprawl (gateway, token vault, HSM/KMS, 3DS, fraud, settlement) fragments evidence and slows reviewers.

- Manual evidence hunts delay acquirer onboarding, bank due-diligence, and scheme reviews.

- Undefined owners erode accountability and blur remediation, especially during releases/scope changes.

- HSM/key ceremonies lack consistent trails (dual control, KCVs, rotations); artefacts go missing.

- SCA/3DS exemptions aren’t evidenced clearly, increasing chargebacks/fines risk.

- Multi-jurisdiction obligations (DORA, NIS 2, GDPR) create inconsistent proofs across markets.

An ISO-first operating system fixes this by linking risks, controls, assets, owners, and evidence into one narrative, making ownership visible and readiness continuous.

Regulatory Alignment Between ISO 27001, PCI DSS, PSD2/RTS SCA, GDPR, ISO 27701, DORA and NIS 2

Supervisors, banks, and schemes care about resilience they can verify—not slideware. ISO 27001’s risk-based backbone translates into the operational discipline assessors expect. When ownership, cadence, and evidence stay visible, responses land faster and third-party exposure narrows.

How ISO-First Maps to PCI DSS / PCI PIN / P2PE

- Scope control: Clear PCI boundary with network/data-flow diagrams tied to services and owners.

- PCI artefacts: ROC/SAQ, AOC, ASV & pen tests, segmentation tests linked to controls and periods.

- Key management: Key ceremonies, dual control, HSM logs, KCVs, rotations captured and reviewable.

How ISO-First Maps to PSD2/UK PSRs & Card Scheme Rules

- Strong Customer Authentication: 3DS server/SDK logs, challenges, exemption rationale, failure/appeal trails.

- Ops readiness: Uptime/SLA/DR evidence with RTO/RPO and failover drills.

- Disputes/chargebacks: Case files, reason codes, and representment packs connected to CAPA.

How ISO-First Maps to GDPR & ISO 27701

- Privacy records: RoPA, DPIAs, DSR logs, cross-border transfer registers, and DPAs.

- Open banking: Consent logs and TPP audit trails tied to services and retention.

How ISO-First Maps to DORA / NIS 2

- Operational resilience: BIAs, scenario tests, incident lifecycle and impact tolerances with trend reporting.

- Outsourcing/TPRM: Tiering for acquirers, schemes, KYC/KYB, open banking; obligations and monitoring linked to contracts.

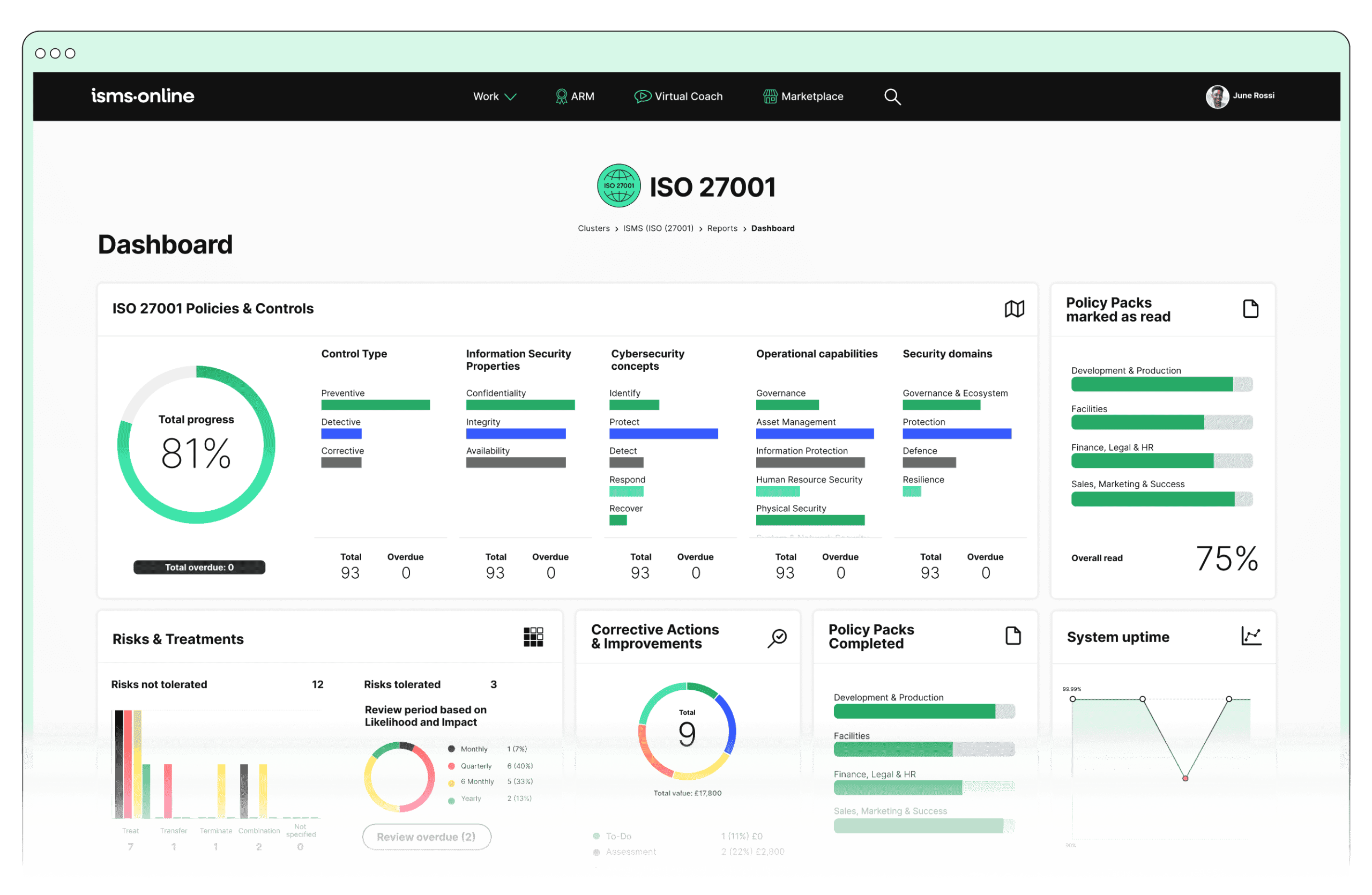

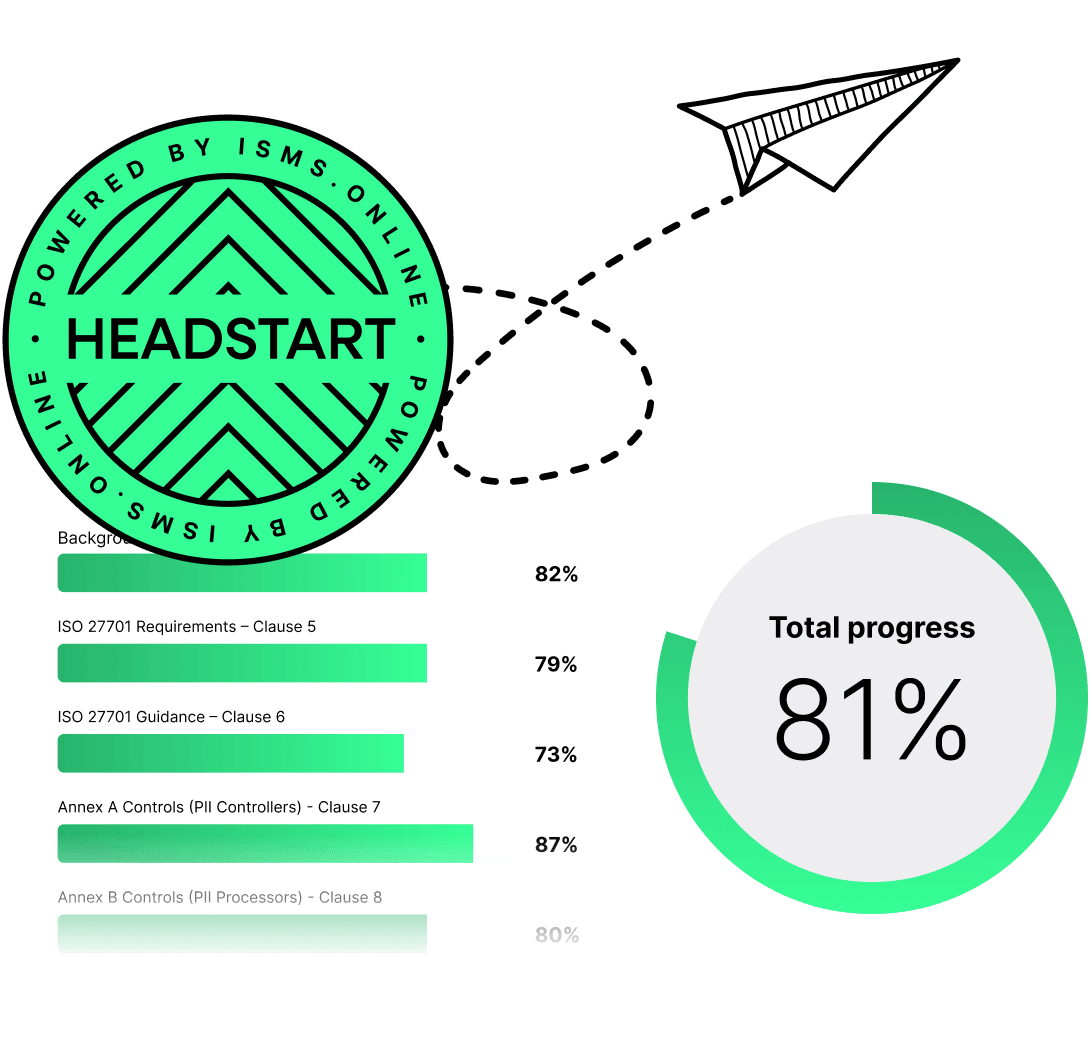

ISO 27001 made easy

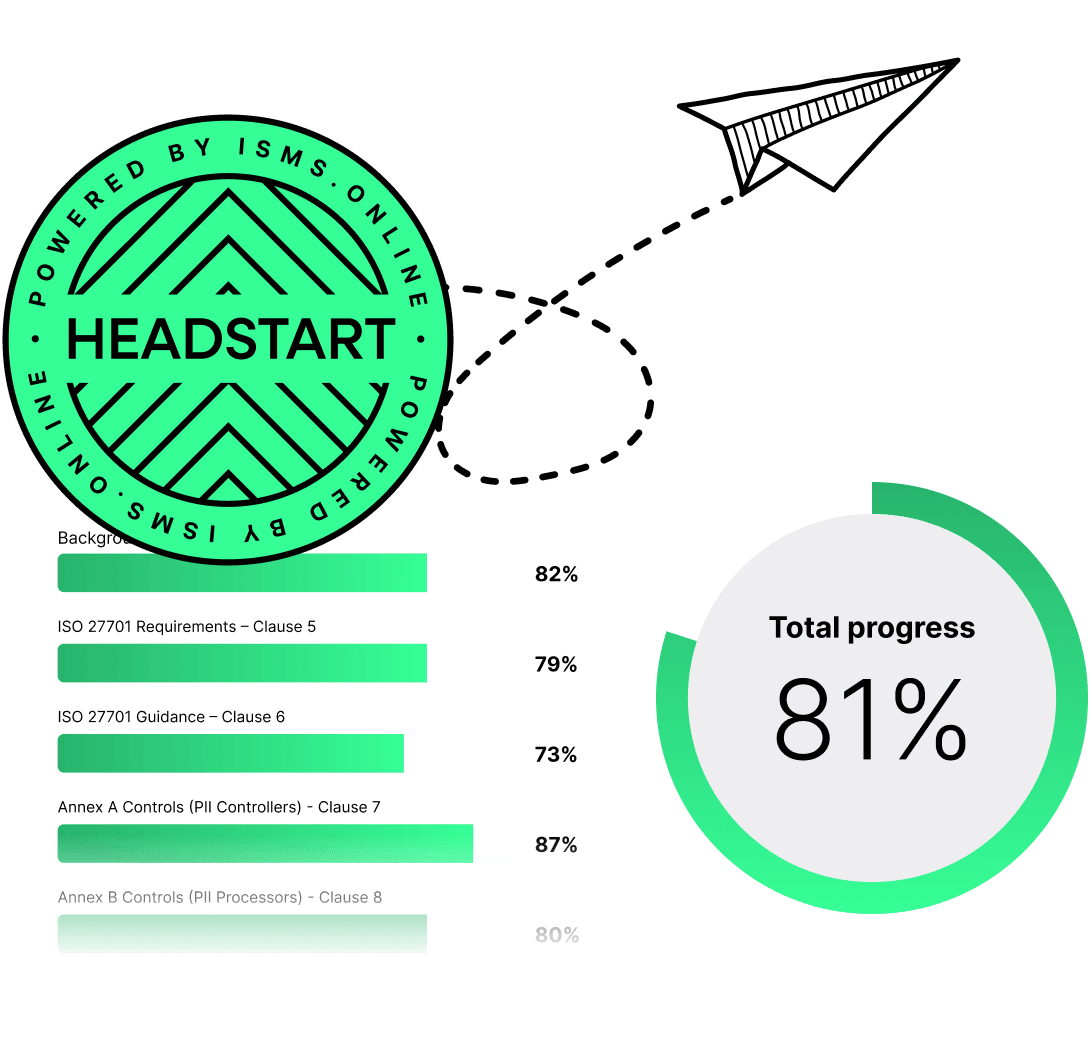

An 81% Headstart from day one

We’ve done the hard work for you, giving you an 81% Headstart from the moment you log on. All you have to do is fill in the blanks.

Risk Management That Actually Runs for the Payments Sector

Stop lurching from assessment to assessment. Linked risks, controls, assets, and owners clarify accountability; consolidated views improve executive decisions. Evidence reuse speeds PCI and bank diligence, while management reviews drive continuous improvement without fire drills.

- Identify: Capture risks at service/asset level (gateway/API, vault/tokenization, HSM/KMS, 3DS, fraud engine, open banking, settlement/recon, cloud); map PAN flows and threat models.

- Treat: Assign actions, map to controls and CAPA, set due dates; keep a traceable history that becomes audit-ready evidence.

- Monitor: Run recurring checks (ASV scans, pen tests, 3DS logs, key events, access recerts, DR tests) and collect artefacts for reuse.

- Review: Hold scheduled management reviews; record decisions, acceptances, and exceptions to steer priorities.

- Report: Share concise KRIs and trendlines with executives, acquirers, and schemes.

- Renew: Roll forward linked evidence and SoA updates so ROC/SAQ, bank DDQ, and scheme attestations move faster.

A ISO 27001 Software Features Checklist — What to Look For

CTO / VP Engineering

- ISO-first backbone prevents evidence sprawl; integrations act as data feeders.

- Change history & scope control (PCI boundary) protect delivery speed during audits.

- Clear scoping for vaults, HSMs, APIs, microservices across environments.

CISO / Head of Security

- Linked risks–controls–evidence for real status and gaps.

- Dynamic SoA improves assessor confidence and speeds Q&A.

- Incident/vuln workflows and exception tracking keep remediation on course.

Head of Payments Operations

- Scheme/acquirer onboarding packs and uptime/SLA reporting.

- DR drills with results; smoother attestations.

- Dispute/chargeback exports with KPIs.

Risk & Fraud Lead

- 3DS/SCA logs and exemption evidence; BIN/route changes with audit trail.

- Fraud trends → CAPA traceability; clear ownership of mitigations.

Compliance Director / MLRO

- AML/KYB workflows and audit trail; outsourcing register for acquirer/KYC/open banking.

- Mapping to PSD2, DORA/NIS 2, and scheme requirements; exportable regulator packs.

DPO / Privacy Lead

- RoPA/DSR/DPIA records; cross-border logs and DPAs in one place.

- Policy lifecycle with approvals and attestations.

Finance & Settlement Controller

- Reconciliation & break handling packs; records retention/WORM proof (if applicable).

- Clean exports for auditors and partners.

Scheme Compliance Manager

- Scheme rule change log & attestations; quarterly/annual checklists.

- Evidence bundles for fine/assessment mitigation.

ISO 27001 Software Capability Comparison

| Capability | Why it Matters to Payments | What Good Looks Like |

|---|---|---|

| ISO-first system of record | One narrative for assessors, banks, schemes | Linked risks, controls, assets, owners, evidence |

| Dynamic Statement of Applicability | Faster Q&A and fewer follow-ups | Live statuses, rationales, change history |

| Linked objects & RACI | Clear ownership → fewer dropped balls | Bi-directional links, assignees, due dates, CAPA |

| Management reviews workspace | Sustained cadence and measurable progress | Scheduled reviews with decisions and exceptions |

| Evidence reuse & export packs | Shorter PCI/partner cycles | On-demand exports by control, period, request |

| PCI artefacts (ROC/SAQ/AOC/ASV/Pen/Scope) | Avoids parallel paperwork | Versioned, time-bound, mapped to services |

| 3DS/SCA evidence & exemptions | Lowers chargebacks/fines risk | Auth flow logs + exemption rationale + outcomes |

| Key management lifecycle (HSM/KMS) | Reduces key-custody risk | Ceremonies, dual control, logs, KCVs, rotations |

| Supplier/TPRM (acquirer/schemes/KYC/OB) | Tames critical dependencies | Tiering, obligations, SLAs, monitoring |

| Policy lifecycle & attestations | Prevents drift | Versioning, approvals, attestations, reminders |

| Change/scope management (PCI boundary) | Protects speed while audit-ready | Releases, diffs, approvals, rollback |

| Operational resilience (DORA/22301) | Underpins tolerances & drills | BIAs, tests, results, re-tests |

| Privacy records (GDPR/27701) | Satisfies DPA & buyer checks | RoPA, DPIAs, DSRs, transfers, DPAs |

| Exec/board overviews & KRIs | Faster decisions | Concise roll-ups of risk & control health |

Free yourself from a mountain of spreadsheets

Embed, expand and scale your compliance, without the mess. IO gives you the resilience and confidence to grow securely.

Benefits in 90–180 Days You Can See

Shift from PCI/scheme sprints to a steady operating rhythm that compounds value across launches, renewals, and diligence.

- Faster acquirer & scheme onboarding with pre-mapped evidence bundles.

- Lower PCI audit drag & cost via continuous readiness and reuse.

- Stronger regulator/bank partner trust through a single, coherent narrative.

- Predictable renewals with stable capacity planning.

- Team momentum from scheduled reviews and CAPA tracking.

- Framework reuse across PCI, PSD2/RTS SCA, GDPR/27701, DORA/NIS 2, SOC 1/2, 22301—without duplicate projects.

- Cleaner SCA/3DS & dispute governance that reduces losses and findings.

When risks, controls, and evidence live in one system of record, audit packs assemble from the work itself and stakeholders verify readiness at a glance.

Best ISO 27001 Compliance Software for Payments Sector — A Quick Shortlist

ISMS.online ⭐

An ISO-first system of record built to run the ISMS—not just pass an audit. Guided workflows link risks, assets, controls, owners, and evidence so questionnaires shrink and reviews stay predictable.

A dynamic SoA, management reviews, and exportable PCI/partner packs keep readiness continuous across ISO 27001 today and PCI DSS, PSD2/RTS SCA, Scheme Rules, DORA, NIS 2, SOC 2, GDPR, ISO 27701, SWIFT CSCF, ISO 22301 tomorrow. Connectors can feed artefacts; the ISMS keeps the governance cadence.

Vanta

Automation-forward with strong integrations and continuous tests that speed artefact collection. Great for gathering evidence fast; you still define policy lifecycle, ownership, and reviews to sustain ISO 27001 maturity.

Drata

Polished automation and monitoring with a broad connector story that accelerates collection. Helpful for evidence gathering; set a firm management rhythm so governance and corrective actions don’t slip.

Sprinto

Price-forward automation with a wide integration surface that moves quickly from zero to audit. A pragmatic on-ramp; long-term outcomes rely on clear owners, milestones, and recurring management reviews.

Secureframe

Automation plus questionnaires and trust-centre features at higher tiers can speed diligence. Ensure your internal cadence—reviews, internal audits, and CAPA—remains the backbone of maturity.

DataGuard

Hybrid software + services works when internal capacity is thin. Weigh commercial complexity and keep one authoritative system of record for day-to-day operation.

Strike Graph

Automation/GRC-lite with public pricing offers a solid entry point. Validate how risks, controls, and evidence roll up into a management-ready narrative.

HiComply

Template-led approach with transparent tiers speeds initial drafting. Lasting value comes from clear ownership, traceability, and a steady review cadence across the year.

See the ISMS.online Platform in Action Now

A live ISMS.online walkthrough shows end-to-end traceability across risks, controls, owners, and evidence.

You’ll see how a linked Statement of Applicability speeds PCI/scheme responses, how a steady governance rhythm sustains improvement, and how cross-mapped evidence helps you reuse work across PCI DSS, PSD2/RTS SCA, DORA, NIS 2, SOC 2, GDPR, ISO 27701, SWIFT CSCF, ISO 22301 without duplicate projects.

Find out how we can help by booking a demo.

Frequently Asked Questions

What makes compliance software “payments-ready”?

An ISO-first backbone that links risks, controls, owners, and evidence; live SoA; PCI artefacts (ROC/SAQ/AOC/ASV/pen/segmentation); 3DS/SCA logs and exemptions; HSM/KMS lifecycle (ceremonies, dual control, KCVs, rotations); outsourcing register; DR evidence; privacy records; and exportable partner packs.

ROC vs SAQ — which applies to us?

Depends on merchant/provider level and scope. Service providers commonly undergo a ROC by a QSA; some sub-scopes may use SAQs. A strong ISMS makes either route faster by pre-organising evidence and owners.

How does this map to PCI, PSD2/RTS SCA, DORA, and GDPR/27701?

Risk-based controls align to each regime’s themes (security, SCA, resilience, privacy). Management reviews and linked evidence show design + operating effectiveness; assets and owners carry across frameworks without rework.

How are key ceremonies and HSM logs evidenced?

Store ceremony minutes, participants, dual-control proofs, KCVs, rotation records, and HSM event logs with timestamps and approvers—then schedule periodic reviews and recertifications.

What about 3DS/SCA exemptions and disputes?

Record exemption rationale (TRA, low-value, MIT, whitelisting), outcomes, and appeal trails. Link chargeback cases to controls and CAPA to reduce repeat losses.

ASV scans, pen tests, segmentation—how are they handled?

Maintain scope diagrams and test plans; store ASV/pen/segmentation reports with dates, findings, owners, and closure evidence. Map each to controls and the SoA for quick retrieval.

What are typical cost drivers?

Seats, frameworks/jurisdictions in scope, assurance depth (evidence history, SoA detail, outsourcing/key-mgmt oversight), entity count, and integrations.

What does implementation look like?

Scope services and assets (gateway, vault/HSM, 3DS, fraud, settlement, cloud), import policies and risks, link controls and evidence, schedule reviews, and assemble PCI/partner packs directly from the work.

Integrations vs backbone—do we need both?

Connectors speed artefact collection. The ISMS remains the source of truth for ownership, reviews, and improvements.

How do we prep for the next ROC/SAQ or scheme review?

Continuous reviews, internal audits, and corrective actions build re-usable assessment packs. Predictable cadence stabilises effort and timelines year over year.